Investing for Kids using Stockpile

This post may contain affiliate links, which means I may receive commissions when you click these links, at no cost to you (sometimes you may also get something in return). Please understand that I have experience with all of these companies (as in I have invested my own money), and I recommend them because they are helpful and useful, not because of the small commissions I make if you sign up. Please read my disclaimer for more info.

As a parent, you want to do the best for your kids and set them up for success. Investing is not just for adults! With some help from you, kids can invest too. There are many way you can do this, however, in this blog I will cover how you can get started using Stockpile without investing millions (or even hundreds) of dollars.

Why Invest for Kids?

I wish I knew what I know today about investing when I was in my early 20s. I am in my 30s (ok fine, late 30s) and had I known what I know today, I probably would be sitting on a beach with a cold beer right now, instead of wondering why it’s the middle of April and I still see snow outside. I am not alone. I’ve heard this from friends, family and countless folks on investing forums and discussion groups.

So, why invest for your child? To teach them at an early age about investing. My son is 3 years old, so he’s too young (I think) to start learning about investing, BUT, in a few years he will start to understand the basics and as a teenager he’ll know a lot more about investing than I did in my 20s. Yes, making a boatload of money is nice, but the lesson will be more valuable than any return you make.

Choosing an Investment Option for your Kid(s)

There are a few popular options. I say options, but you don’t have to pick one. You can, and probably will do more than one of these.

- 529 Account – to keep things very simple, this is a tax advantaged account so you can pay for your child to go to college. I opened a 529 account when my son was born and contribute a fixed amount every month. If you need more details just ask Google or click here.

- If your kids have earned income (like baby sitting, lawn mowing etc.) you can open a Roth IRA for them.

- Open a custodial brokerage account – yes, I am finally getting to the point of this blog. This is an account where, you the parent will invest on behalf of your child. When your child turns 18 or 21 (depending on state law) they will have access and control of the account.

Best Custodial Brokerage Account

As with any “what’s the best” question, the answer here is, it depends! The good folks at The Balance have done a great job of covering the options available. I will not duplicate that here, since the focus of this blog is Stockpile and how it works.

Why Did I Pick Stockpile?

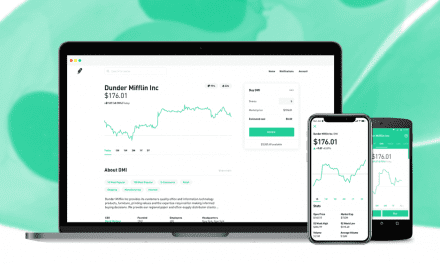

You can always go with the traditional brokerages (such as Fidelity, Vanguard, E-Trade) etc., BUT I picked Stockpile for a few reasons. I want to use this primarily as a way to teach my child about investing. In additional to that, in keeping with the philosophy of this blog, Stockpile checks most of the boxes:

- Low minimums

- Easy to use platform

- Low fees

Getting Started with Stockpile

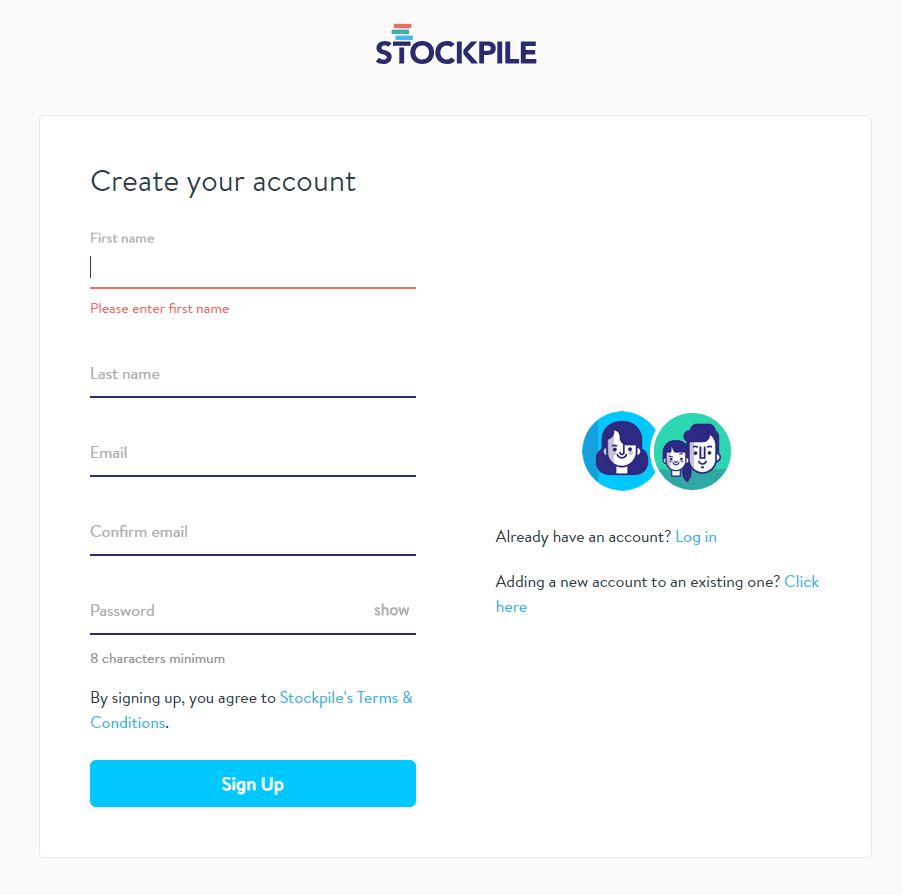

The sign up process is fairly straightforward.

Step 1: Sign up and enter your basic information

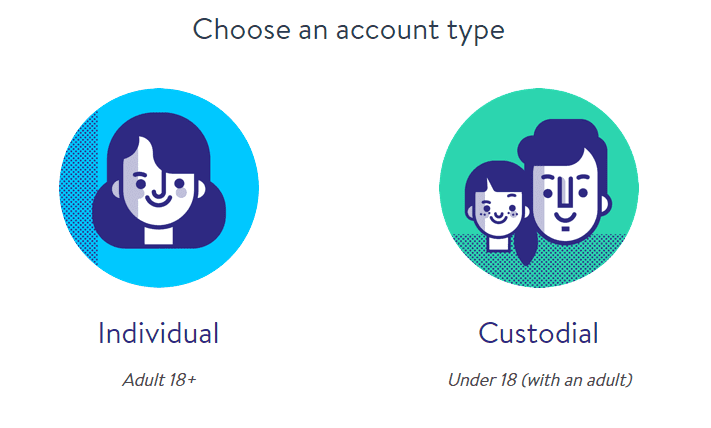

Step 2: Select an account type. On this screen, you want to select “Custodial Account”

Step 3: Just like any other brokerage, you will then need to verify your social security number, address and other information. Just so Uncle Sam can make sure you don’t use this for money laundering or other unsavory activities.

Step 4: Enter information about your child including name and SSN.

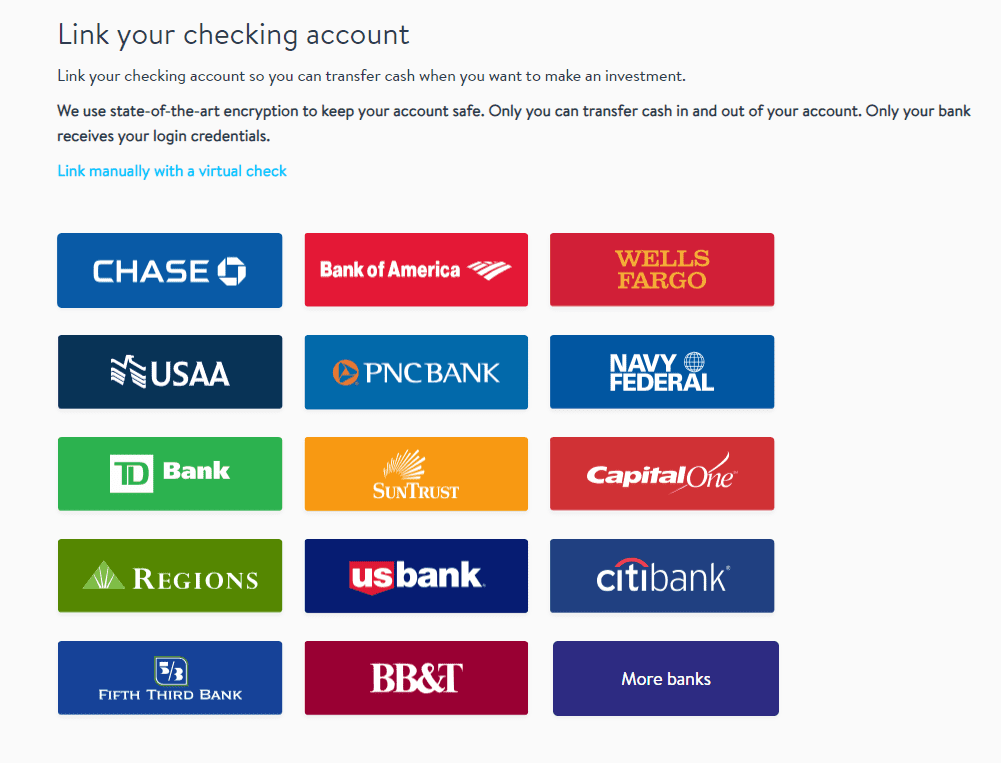

Step 5: Link your bank account (because you need money to invest!) – if you have a checking account from a major bank you will get instant verification. If not it may take a few days after you verify your trial deposits.

Step 6: Wait! After you do the above steps, your account will typically get approved in 30 minutes.

Step 7: Transfer funds from the account that you linked. Some platforms like M1 and Robinhood will let you (up to certain limits) start trading immediately without having to wait the 2-3 days it takes for the funds to be transfered. Stockpile does not. So take a chill pill and cool your jets for a few days before buying stocks. I am mad and impatient, so I found this annoying, but, assuming your child isn’t turning 18 tomorow, this should not make any difference in the grand scheme of things.

Buying Stocks

Alright, your account is approved and you are ready to get started. Hmmm, so many stocks, so little money… what to buy?

At some point in the future, when I explain this to my child, I want the stocks I pick to be something that he can relate to. He really enjoyed the last trip to Disneyland and watches Netflix all the time, so I am going to pick those two stocks to start with. At the time of writing, Disney just announced their streaming service that will compete with Netflix, and as a result Netflix dropped a bit. So it’s probably a good time to invest in both. If your child is old enough and wants to pick a stock or company to invest in, let him/her. It doesn’t matter if you think it’s a bad idea or the timing is bad or the P/E ration is not where you want it to be. It’s important to learn that sometimes you pick winners and sometimes you pick losers… oh I didn’t mean to say losers, I meant companies that really really tried hard, but didn’t quite make it.

To get some diversification and less volatile returns, you can also pick a few index funds (such as an S&P 500 ETF). As far as teaching your kid(s) goes, I would wait until your child is late in his/her teen years before teaching them the intricacies of index funds vs mutual funds.

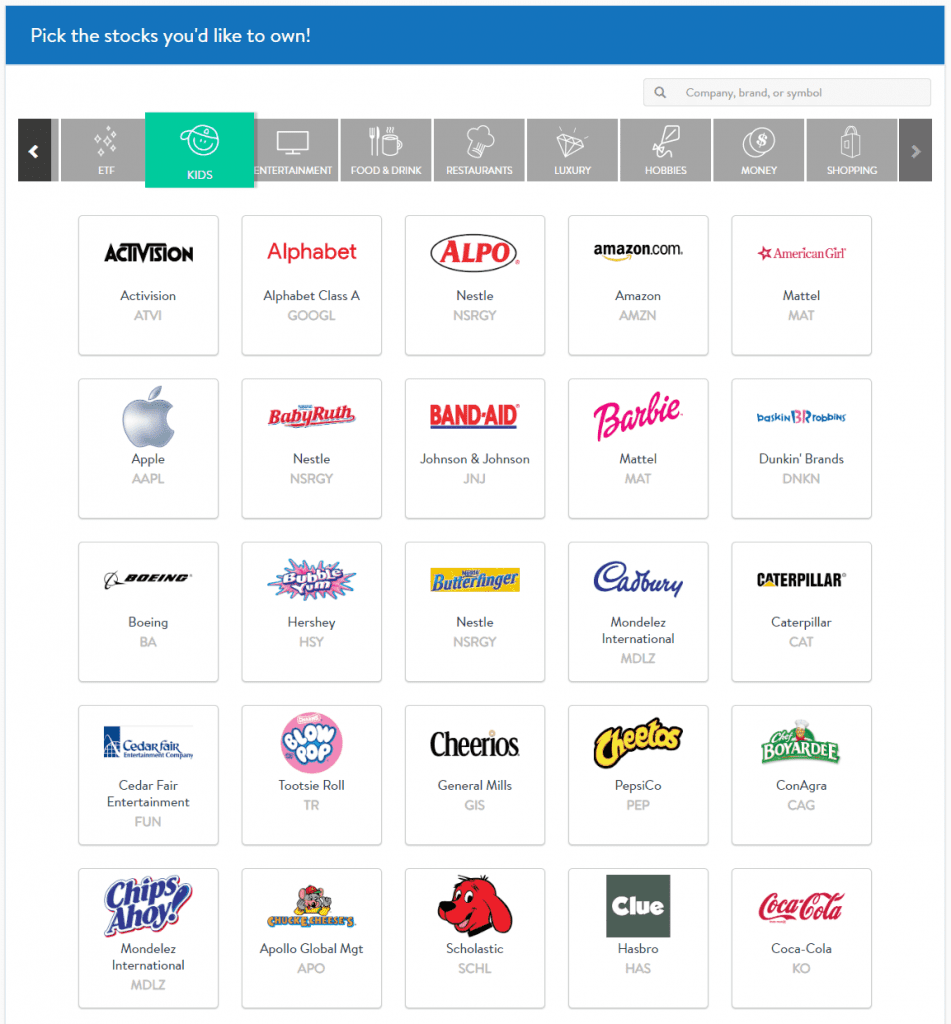

What’s kind of cool about Stockpile is it identifies the stock by showing recognizable icons/names that kids (and even some adults) will understand. When you click on “buy stock” you are presented with a screen that allows you to either search or browse by category. For this exercise, I am going to browse by the “kids” category. You can see that I now get a filtered list of stocks that kids can relate to (for the most part).

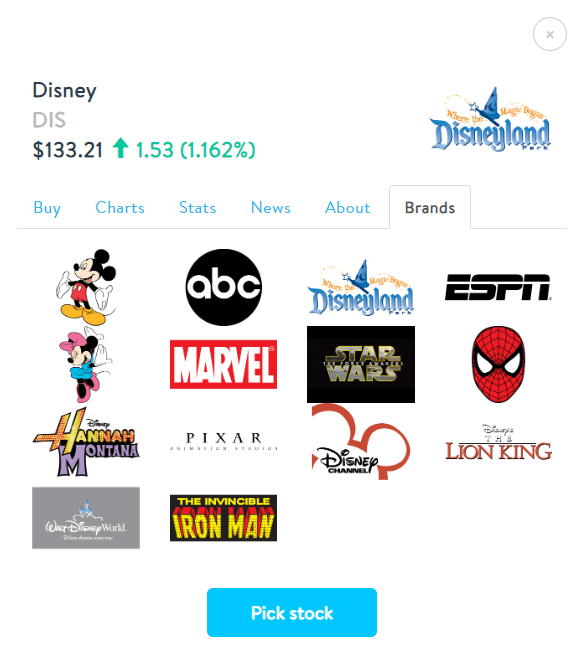

Since I am looking to buy Disney (DIS), if I search, I am presented with something that’s less corporate and really easy for your 8 year-old to relate to. Pick the icon you want (I picked the “disneyland” icon), and it gives you some basic information. If you want to do detailed research, I would suggest using other tools. Stock research is not a strong feature, but, then again that’s not a big deal since there are tons of places to do that. Don’t tell E-Trade, but I use their research tools if I want to do detailed research on a particular stock. Back on the Stockpile screen, if you click the “Brands” it’ll show you some of the brands related to Disney.

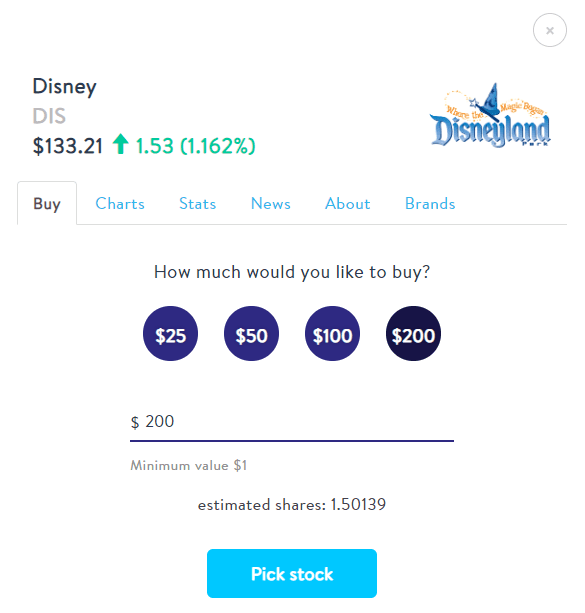

To start off I will invest $200.

The estimated number of stocks I will get is 1.50139. Why estimated? Remember, Stockpile allows fractional shares (where you don’t need to get a whole share) and most platforms that do that will place the trades at the end of the day or the following day. It’s not possible to have both fractional shares and live trades executed.

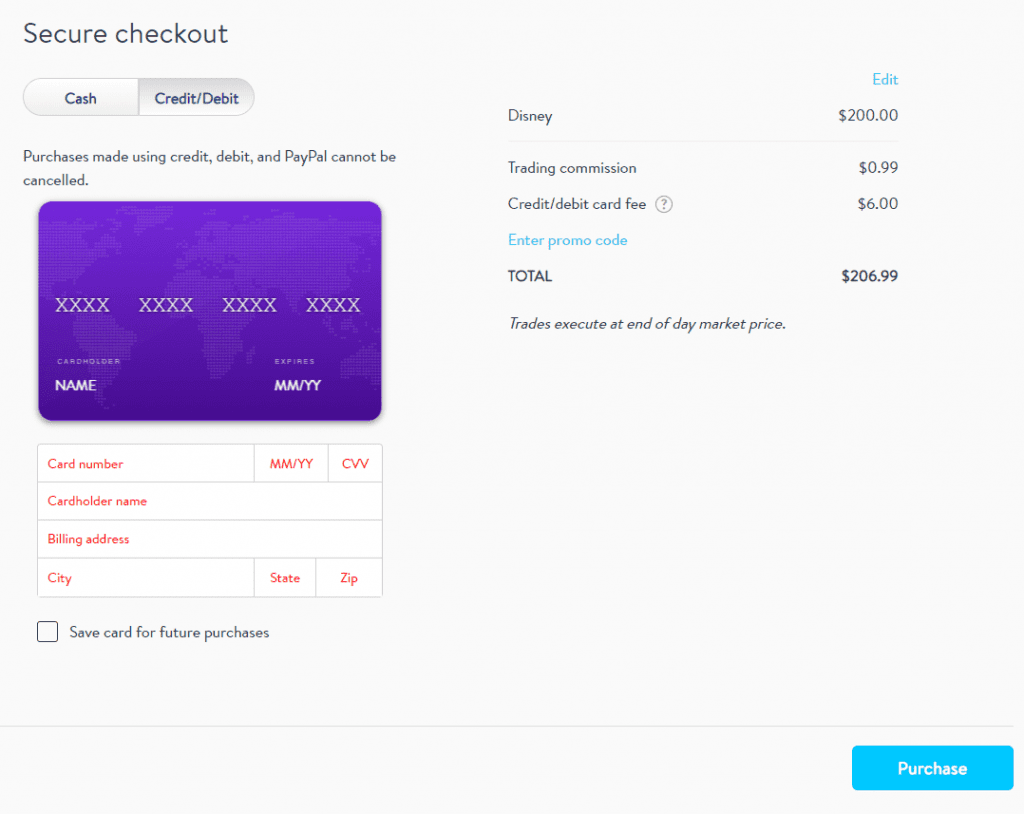

One thing that I found unique about Stockpile is that they will let you buy stocks with a credit card, BUT, they will charge you a 3% fee. I am not going to do this and would strongly suggest that you don’t do it either. But it is still an option and worth mentioning.

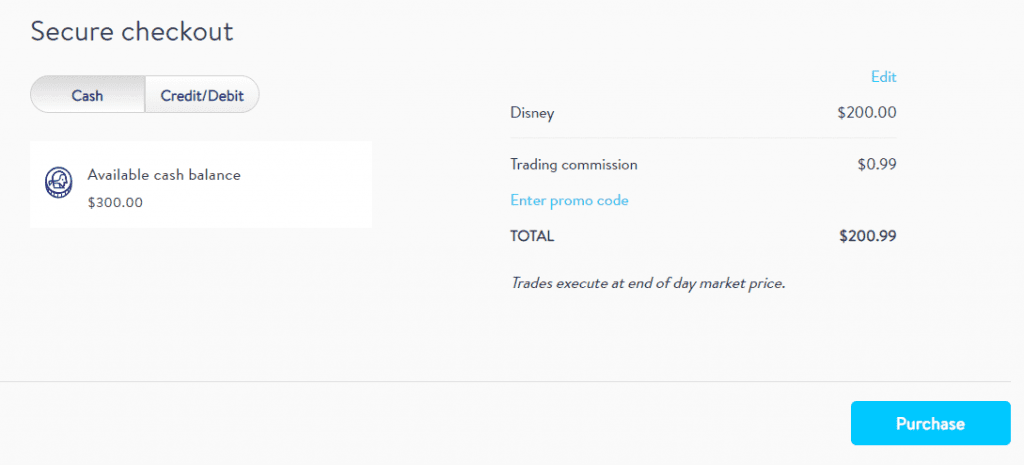

Ok, I am switching back to cash. I see that I have the funding available to get $200 in Disney and to cover the $0.99 fee. Once you click the button you’ll get a message saying the trade will be placed at the end of the day.

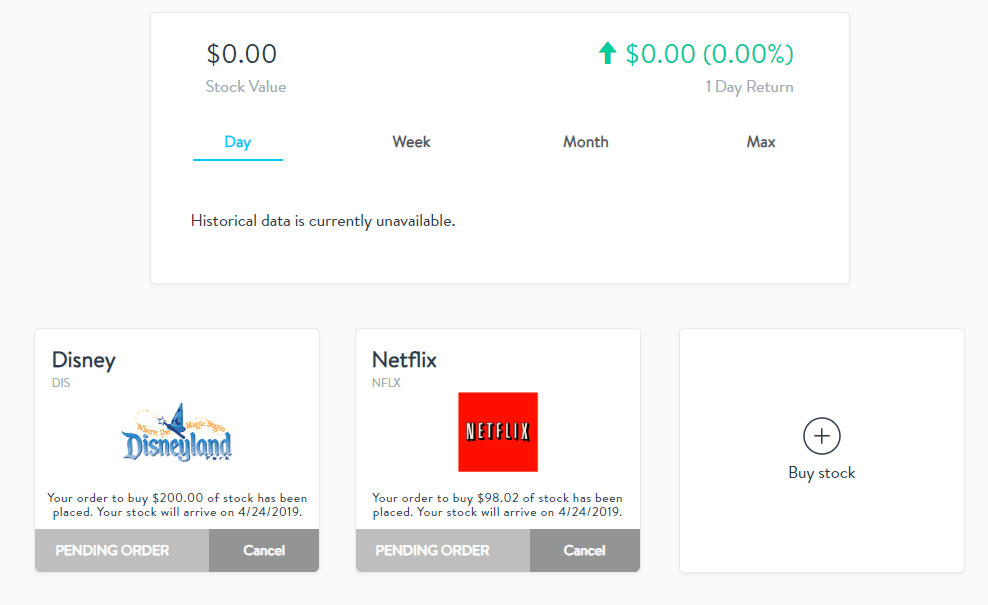

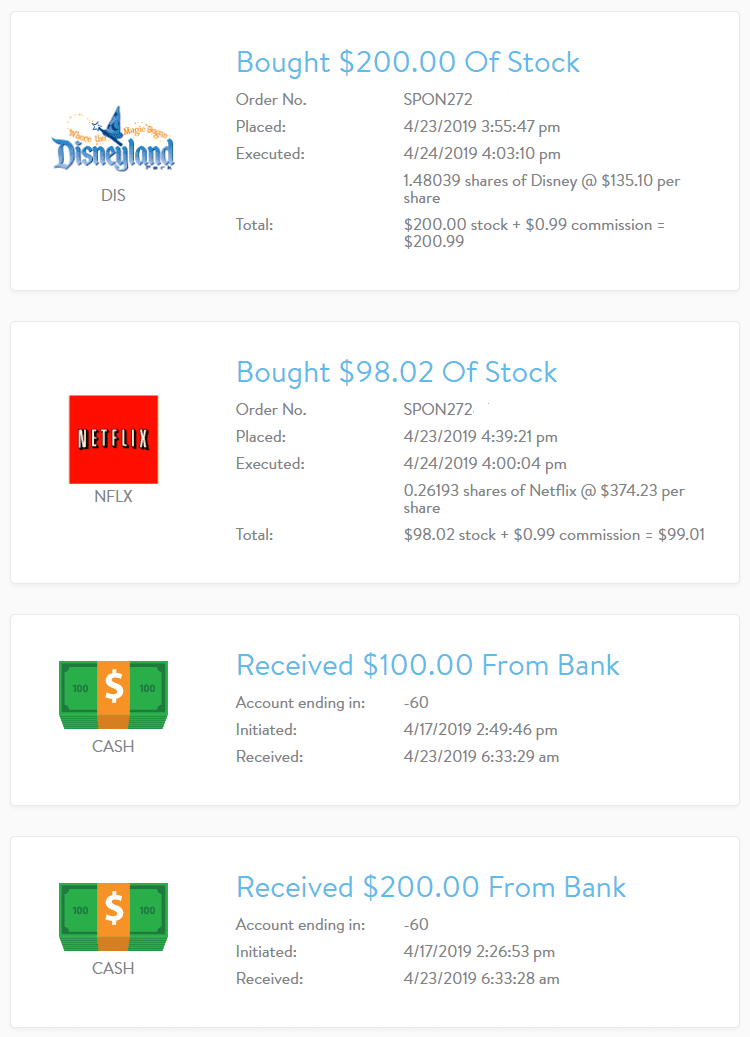

My son loves Netflix too, so as planned I am going to get $100 of Netflix! If I now check my stock overview page, it shows that my stocks will arrive the following day. But Mr Mad Investor, why did you get only $98.02 of Netflix, you might ask. Well, not only am I mad, but I also can’t count. I transferred $300 and forgot about the trade commission. Stockpile did not forget, so I was only able to get $98.02 of Netflix. When you transfer funds with the intention of purchasing several stocks, don’t forget about the commission!

My son loves Netflix too, so as planned I am going to get $100 of Netflix! If I now check my stock overview page, it shows that my stocks will arrive the following day. But Mr Mad Investor, why did you get only $98.02 of Netflix, you might ask. Well, not only am I mad, but I also can’t count. I transferred $300 and forgot about the trade commission. Stockpile did not forget, so I was only able to get $98.02 of Netflix. When you transfer funds with the intention of purchasing several stocks, don’t forget about the commission!

Remember when I picked DIS, I chose the “disneyland” icon. Depending on what interests your child, pick something that he/she would relate to, whether it’s Mickey Mouse, Star Wars, or Spider man. When they login and see this, it relates better than a corporate logo which won’t mean much to a younger child. While this is a small detail, I thought it was a nice touch from Stockpile.

Remember when I picked DIS, I chose the “disneyland” icon. Depending on what interests your child, pick something that he/she would relate to, whether it’s Mickey Mouse, Star Wars, or Spider man. When they login and see this, it relates better than a corporate logo which won’t mean much to a younger child. While this is a small detail, I thought it was a nice touch from Stockpile.

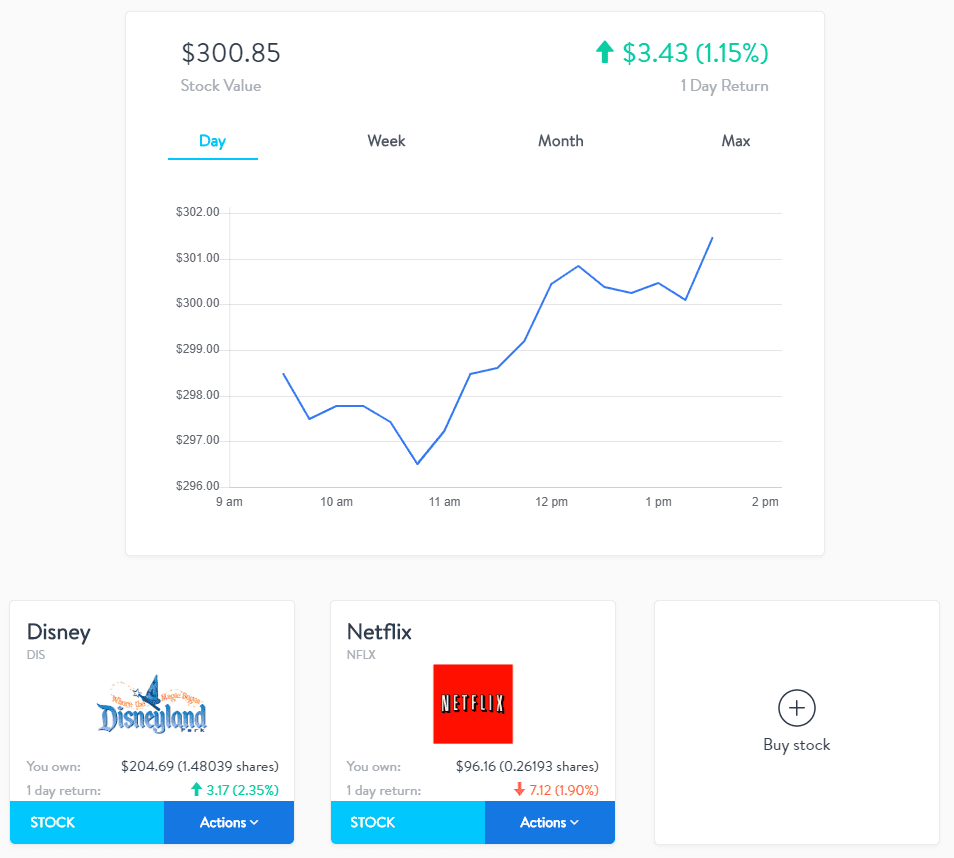

With Stockpile, the order will be executed by the end of the day if you place your order before 3pm ET. I placed the order just after 3pm, so it took a couple of days to settle. When I logged in to my account 2 days later, I see that my son is now the proud owner of Disney and Netflix (along with a few million others).

Looking at the the final trade numbers you can see that the estimate I got for Disney was 1.50139 shares and I ended up with 1.48039 shares. Again, the reason for the difference is because the trade is placed at the end of the trading day and the number of shares will depend on the stock price. Some people get a bit bent out of shape about this, but it really shouldn’t be an issue at all since you are not doing day trading and over the long term, the price difference between a day or two will not matter (unless you are really bad at picking stocks and the company you picked goes belly up the next day).

Stockpile has a timeline section which gives you a bit more details on when the trades were placed, price etc.

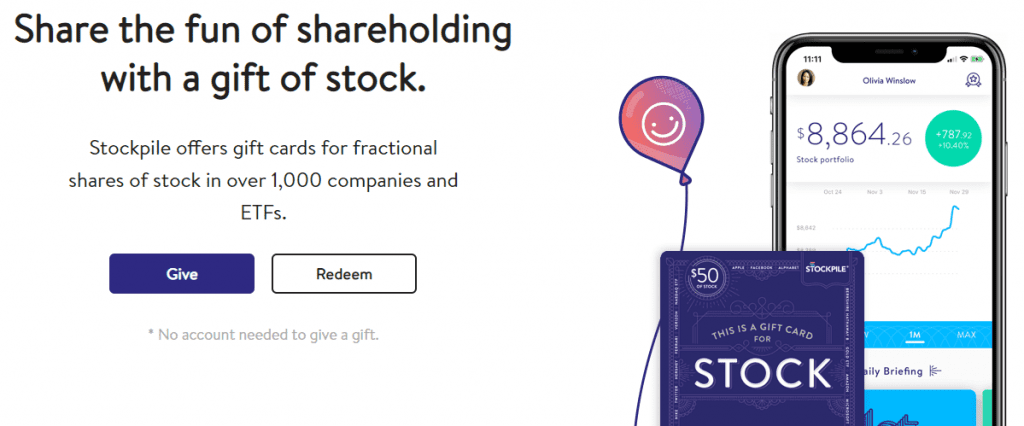

Giving the Gift of Stock

Stocks can be a great birthday or Christmas gift for kids. Tell grandma and grandpa that your child is going to be the next Warren Buffet. Sending a gift card is fairly easy (and you don’t need an account). You can either pick the stocks or ETF you want to gift or send a general gift card so the recipient can pick the stocks. Enter the recipient info, and they will get an email on how to redeem. You can also print or get a physical card if you prefer. By the way, when you send a gift card and pick a stock, think of it more as a recommendation, since the recipient can pick a different stock (which is how you would want it to work) if they wanted to.

As the person giving the gift, you do pay a gift card fee + the commission. The e-gifts and print-at-home gifts cost $2.99 for the first stock and 99¢ for each additional stock, plus a credit/debit card fee of 3%. The plastic cards cost $4.95 to $7.95 depending on the face value. The recipient doesn’t pay anything when redeeming your gift.

What I Don’t Like About Stockpile

The only thing I don’t like about Stockpile is there $0.99 trade commission. Why do I not like it? Well, we do have platforms like M1 and Robinhood that do commission free trades, but don’t offer custodial accounts. The overall trend among “FinTech” companies is to go commission free. If you are making relatively small trades, lets say buying a stock for $25, the commission is 4% and don’t forget that you pay the commission again when you sell, so hypothetically if your gain is anything less than 8% when you decide to sell, you lose money. My hope is that Stockpile will do away with this in the future.

With that said, everybody else that allows custodial accounts charge a lot more ($5 – $10 a trade), so Stockpile is still the best option. I didn’t find a whole lot to complain about, so I had to put something in there.

What I Like About Stockpile

Aside from not being commission free, there’s a lot to like.

- It’s a great way to teach kids about investing

- Low minimums

- Easy to use web and mobile platform

- Low fees – yes I was being a whiny cry baby about this above, but $1 a trade is still really cheap

So if you are looking for the best way to invest for your kids and at the same time teach them about investing at an early age, Stockpile is by far the best option out there.

QUESTIONS, COMMENTS, THOUGHTS, IDEAS?

I hope this review was helpful. Let me know in the comments below how you invest for your children or if you have any questions.