Groundfloor Review – Best Way to Get Started in Real Estate Investing

This post may contain affiliate links, which means I may receive commissions when you click these links, at no cost to you (sometimes you may also get something in return). Please understand that I have experience with all of these companies (as in I have invested my own money), and I recommend them because they are helpful and useful, not because of the small commissions I make if you sign up. Please read my disclaimer for more info.

If you are like me, most of your investments are in stocks, bonds and some in savings. Everybody and their uncle tells you that you gotta get into real estate. That doesn’t sound too hard, you think to yourself. I already own a home or at least I live in a house or an apartment, so I understand real estate better than stocks and bonds and stuff. Well, it’s not that straightforward. To get into real estate you really only have two primary options.

- Buy real estate either for rental income or to flip – are you mad? Even if you had a few hundred thousand lying around, this can be a royal pain in the rear. Why? I could go off in a rant here, but if you really must know, ask me in the comments and I will oblige. I will admit that I did think about buying a vacation rental in Florida, but I dropped the idea when the wife gave me the “have you completely lost your mind” look.

- Real Estate Investment Trusts (REITs) – This is a good option. Lots of platform choices out there for non accredited investors, great returns, good diversification. Main drawback is that the capital is illiquid at least for several years.

Enter Groundfloor into the picture. Before getting into my Groundfloor review of what Groundfloor is and how to invest, let me briefly cover how Groundfloor makes it easy to get your feet wet in real estate investing.

- Low minimum – start investing with just $10

- Liquidity – your funds are tied up for 9 to 12 months on average, sometimes your investment can pay off earlier (more on this later). Of course, not as liquid as the stock market, but much better than REITs

- Diversification – since the minimum investment is just $10 and let’s say you decided to start investing with $100, you could spread that out over 10 loans with different risk profiles.

What is Groundfloor?

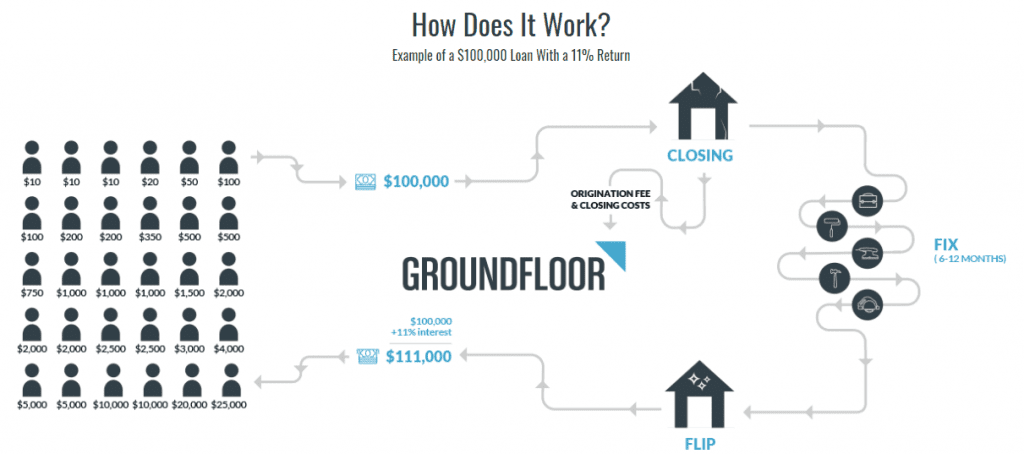

Groundfloor is a crowdfunded platform where investors can participate in loans provided to “real estate entrepreneurs”. In other words, Groundfloor provides short term loans to companies that do fix and flips, new construction and renovate/rent residential properties, and you as an investor can get a piece of that loan with an annualized return ranging from 5% to 25% depending on the risk based grade of the loan.

The illustration below does a great job of explaining this process.

An important point to understand is that you are investing in an LRO or Limited Resource Obligation, which is a debt security issued by Groundfloor. The underlying loan is secured by the property as collateral with Groundfloor usually having first lien. What this means is that if the loan enters into default, Groundfloor will acquire the property, sell it and recover all or part of the capital. However, you as an investor does not own part of the property. If you want to better understand LRO’s, contact their customer support. They are great and when I called, they patiently explained to me how an LRO works.

My Strategy for Investing with Groundfloor

I will now walk through how I got started. Groundfloor being rather unique in this area, I took a cautious approach. By unique I mean Groundfloor is the only platform that does crowdfunded real estate loans. Lending club does crowdfunded loans, but has nothing to do with real estate and in my opinion has a higher risk since there’s no collateral. REITs allow you to get into real estate, however, your capital is tied up for several years and has higher minimum investments.

Initial Investment

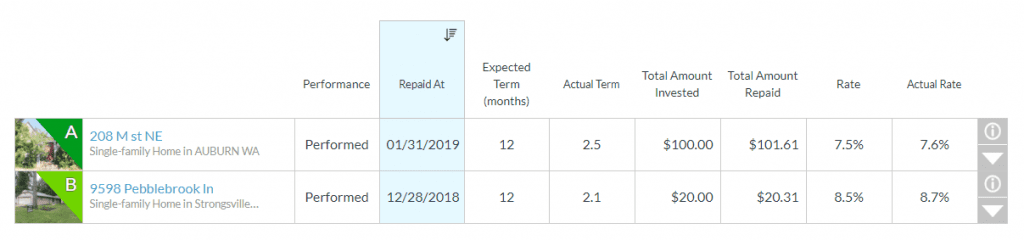

I got started in October 2018 and invested $20 each in 5 loans. One of these loans was paid off early in 2 months.

The loan that was paid off highlighted above had an original term of 12 months, however, was paid of in 2.1 months. This is always a possibility and although it reduces the total expected return, I consider it a positive since I can reinvest in another loan.

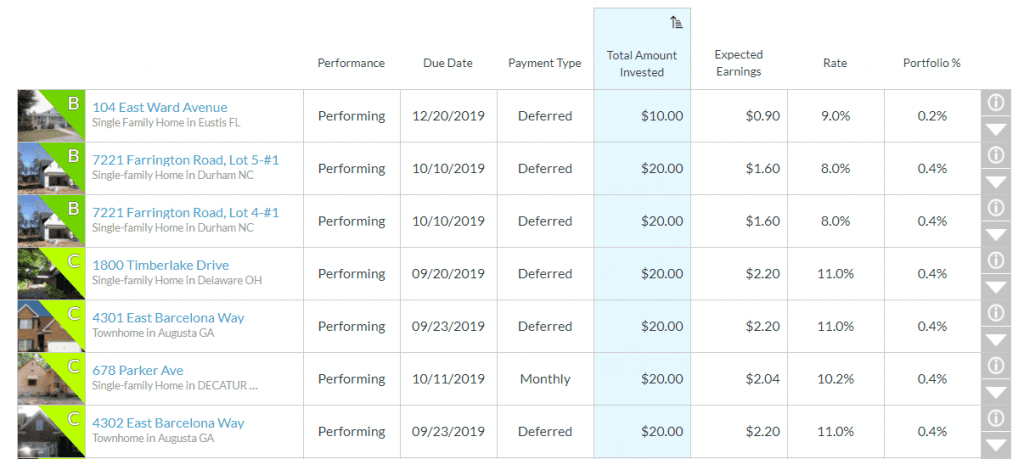

The remaining 4 loans are highlighted below. The summary table shows useful information such as what status the loans are at (performing, default etc.), the payment type, expected due, expected returns etc. In the next section, I will describe how I evaluate loans for investing and cover some of the key terms to be aware of.

How to Evaluate and Invest in Groundfloor Real Estate Loans

After setting up your account, here are the steps involved in investing in a loan.

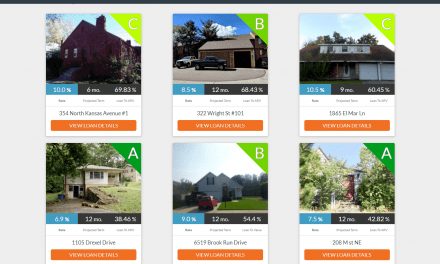

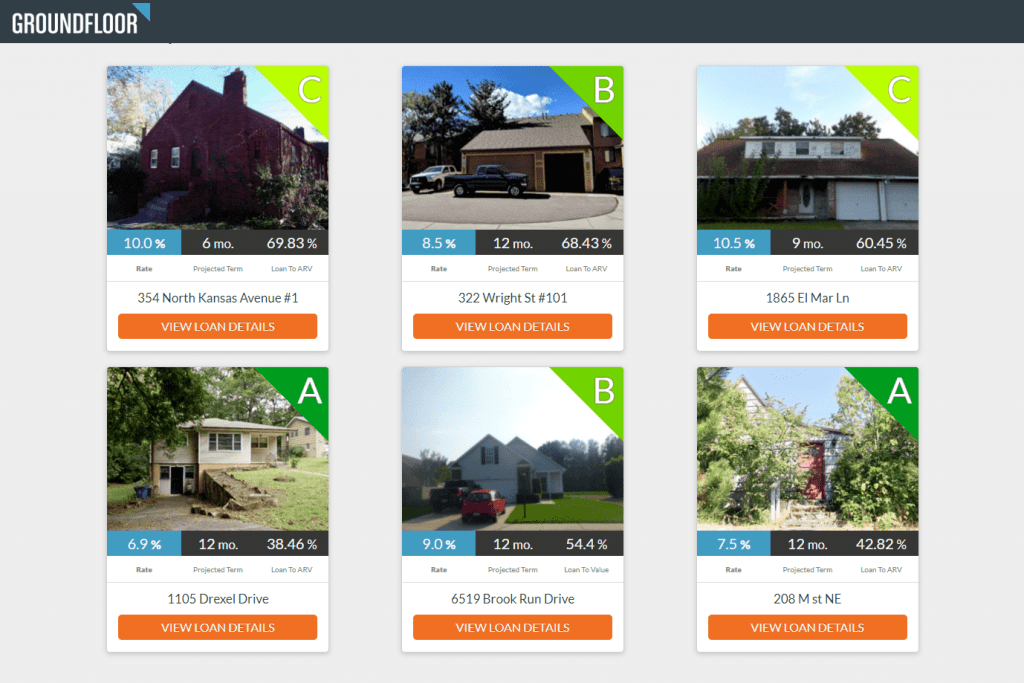

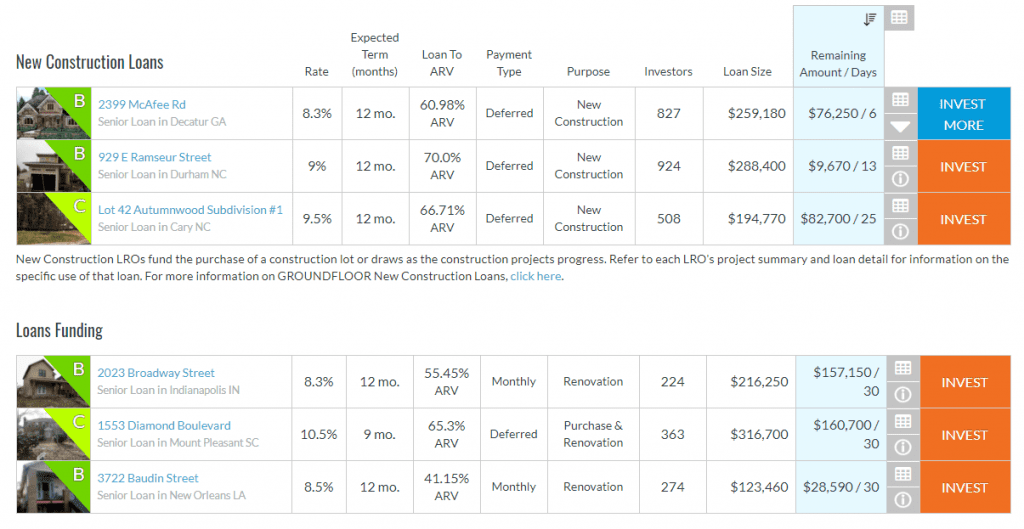

You can browse available loans that are currently being funded to get a quick overview of what is available.

Once you have determined how much you want to invest in total, transferred funds (step 2) and you get to step 3, here’s my strategy/process for evaluating if a given loan is a good investment.

I will break down the key sections of the loan details page and explain the decision process I use.

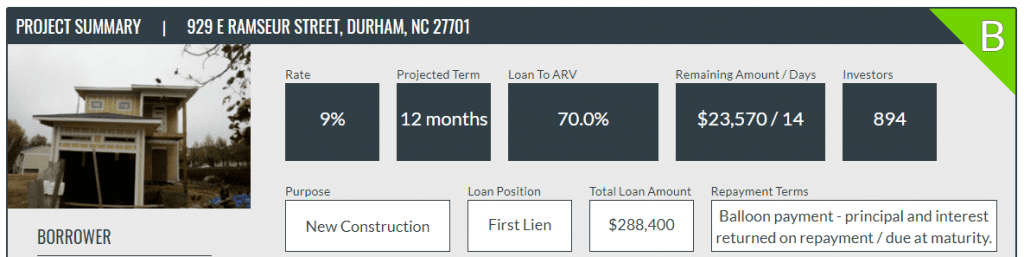

Project Summary Section

Most important factors to consider in this section are:

- Loan grade – Simple grading from A to G, where A grade loans are low risk, low return and G grade loans are high risk high return. Current rates are – Grade A: 5.5% | Grade B: 9.2% | Grade C: 13% | Grade D: 15.6% | Grade E: 19% | Grade F: 23.4% | Grade G: 25.8%. Click here to read more on the loan grading process. In general, I aim to have good diversification on loan grades.

- Loan to ARV – ARV stands for After Repair Value. This is exactly what it sounds like. What will the property be worth after repairs. Lower the value the better. I generally avoid any loans above 75%. For me, ideally I look for ARV’s around 65% mark.

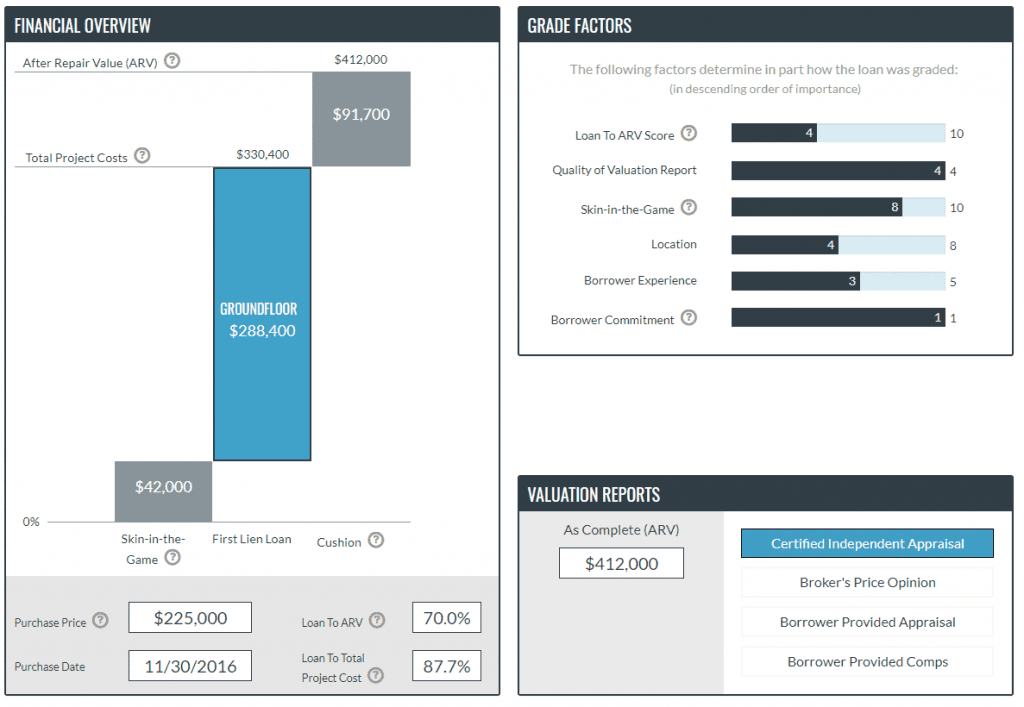

Financial Overview, Grade Factors and Valuation Reports Sections

This is probably the most important section and within this section I focus on the Financial Overview. Here are the key elements.

- Skin-in-the-game – simply put, this is how much of his/her own money the borrower has put in. In other words, what does the borrower have to lose if things go south (i.e. borrower walks away and the loan end up in default). The higher the number relative to the loan amount the better.

- ARV – Let’s talk a bit more about the After Repair Value. I always make sure that the valuation is based on a Certified Independent Appraisal. I want to make sure that the ARV is as accurate as can be. Why? Well if the ARV is overestimated and the borrower can’t sell the property for the price they expected, that increases the risk of default. It’s hard to assess the accuracy of the ARV with a whole lot of certainty, but what I do is go on a website such as Zillow and look at typical red flags. Stuff like, is the borrower trying to sell the property for $500k in a $300k neighborhood, is there a big mismatch between what Zillow estimates and the current value (not ARV) etc. With that said, take any info on Zillow with a grain of salt since accuracy of the Zillow data varies depending on the city and state.

In the example below, the difference between the total project cost and ARV is $91,700, so there’s a decent cushion in case the property sells for less than expected. For this loan if the value was let’s say around $30k, I would not invest anything.

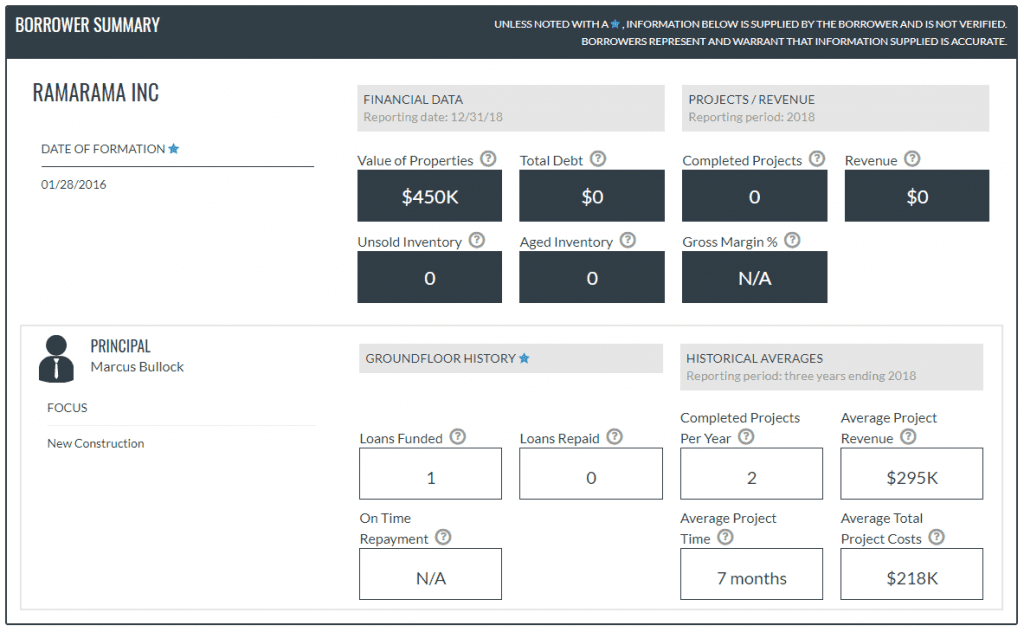

Borrower Summary Section

The last section I look at is the borrow summary.

- Date of formation – if the borrower has been in business for several years, that gives me a higher comfort level than a borrower that started last month.

- Groundfloor history – most of the loans have limited Groundfloor history. However, if the borrower has at least 1 repaid loan that reduces the risk for me.

I don’t put too much weight on other factors here since they are all unverified.

Loan Evaluation Summary

If this seems like too much trouble, and you want to do a quick assessment, look at the Loan to ARV ratio (lower is better) and skin-in-the-game (higher is better).

Once you’ve done this and evaluated the loans available, split the total amount you want to invest such that you have good diversification across loan grades.

Investment Performance Over Time

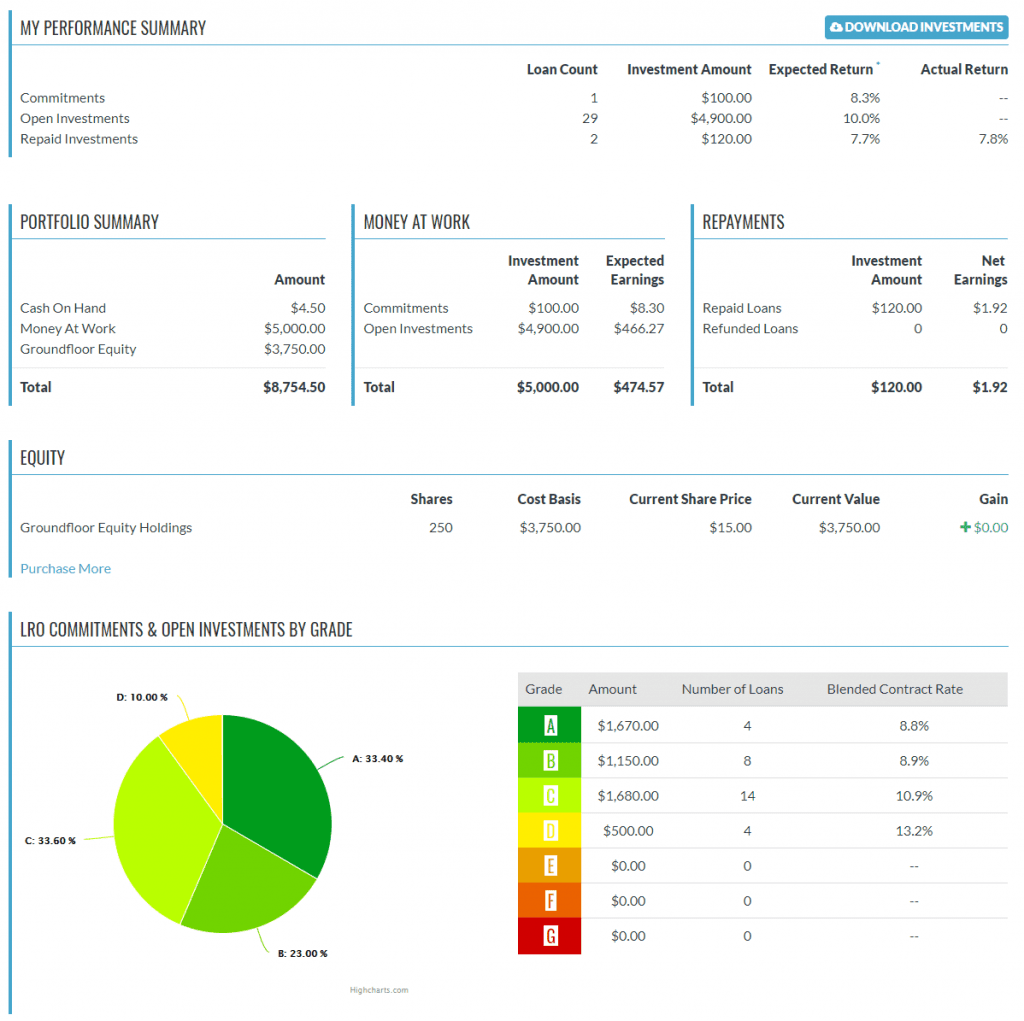

Since October 2018 I have invested a total of $5,000. My strategy for now is to assess where things are at after 1 year (October 2019) and then determine if I want to invest more.

Initial Performance Summary March 2019 (6 months in)

Here’s what my overall investment summary looks like as of March 2019.

Key Takeaways

- $5,000 invested in a total of 31 loans

- 2 have been paid back early with an average return of 7.8%

- Distribution of the loans by grade – more dollars invested in A grade while C and D have a higher number of loans to reduce risk

Summary

Groundfloor does a great job of providing a good return (on average 10%), at lower risk (since the property is collateral) with better liquidity (6-12 months) compared to other real estate investment options such as buying property directly or REITs.

The biggest risk with Groundfloor is the borrower defaulting on a loan resulting in a loss of principal. This blog post by Groundfloor analyzes how their loans have performed. To me the key number is that out of 420 loans repaid, they have been able to return 99.6% of the principle. While past performance is not necessarily an indicator of future performance, I have not seen anything to indicate that this trend will not continue. But I don’t just want to assume. I have invested $20 in several loans which I consider high risk (i.e. high loan to ARV, low skin in the game etc.) so I can see if any of these default for myself.

Getting Started

Groundfloor is a great way to add some diversification for your investments. Here’s how I would suggest you go about it.

Sign up and fund your account with $100 (or more if you are comfortable). Why $100? It’ll let you invest in around 5-10 loans which is a decent number to start with. It will let you monitor how things are going and get familiar with the platform before investing more. How much you choose to invest in each loan really depends on what your total investment is, your risk tolerance and how much work you want to do in analyzing loans. In my case, with a $5,000 total investment I have put in between $100 and $500 for each loan.

QUESTIONS, COMMENTS, THOUGHTS, IDEAS?

I hope this review was helpful and you are able to take what I have done and adapt to your needs. I would love to hear any feedback or questions you have.