M1 Finance Review – Combines the Best of Robo Advisor and Brokerage

This post may contain affiliate links, which means I may receive commissions when you click these links, at no cost to you (sometimes you may also get something in return). Please understand that I have experience with all of these companies (as in I have invested my own money), and I recommend them because they are helpful and useful, not because of the small commissions I make if you sign up. Please read my disclaimer for more info.

There are two type of platforms for investing in stocks – robo advisors for hands off investors and regular brokerages for active investors who want to pick their own stocks. But what if you want both or something in the middle. This is where M1 Finance nails it! In this review, I will be covering my thoughts on the platform as well as specific details on the strategies that I have used.

The Almighty Pie

The central theme that M1 is built on is the concept of pies and slices. Despite it’s simplicity, the way M1 has implemented this idea is nothing short of genius. It allows an investor to setup a really simple pie with a few slices and set it and forget it, OR create a large pie which contains not only slices, but other pies and pies within pies.

What is a Pie?

A pie is a baked dish which is usually made of a pastry dough casing that covers or completely contains a filling of various sweet or savory ingredients. OK fine, I’ll quit trying to be funny, what is a pie in M1? According to M1 help, a Pie is the basic building block of your M1 portfolio. A Pie is a collection of up to 100 slices and for each slice you set the target percentage allocation.

What is Slice?

A slice is a stock, ETF, or another Pie.

A Simple Example

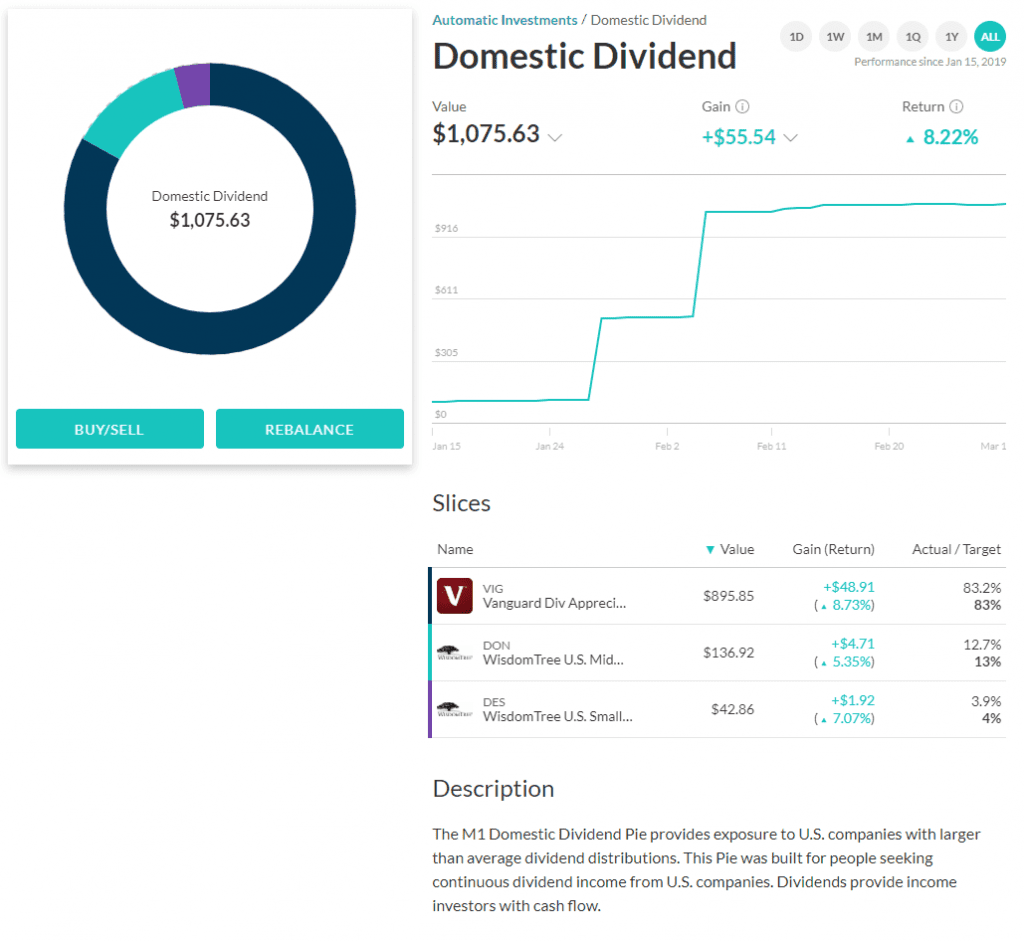

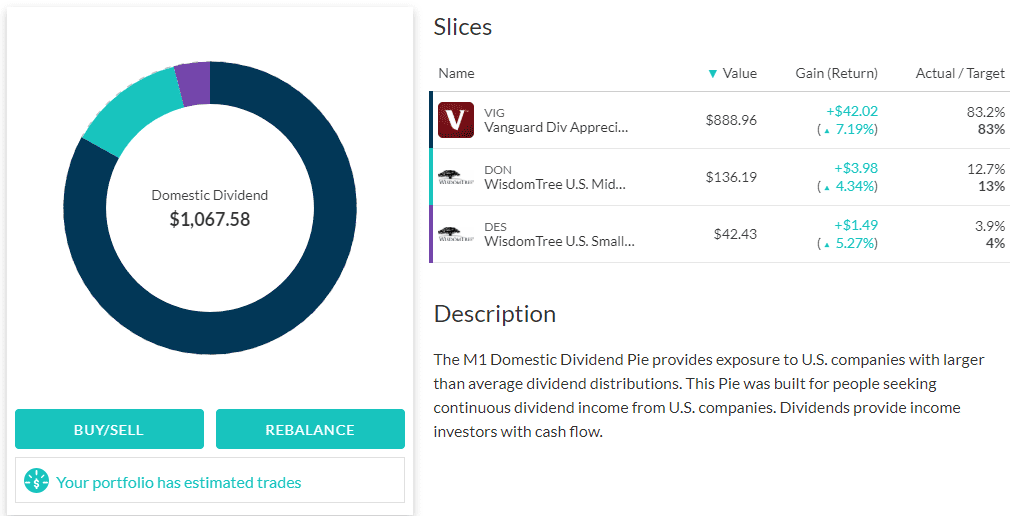

Let’s say you have a moderate risk tolerance and you want to create a simple portfolio of stocks and ETF’s to regularly invest in. A good example of this is the Domestic Dividend expert pie (more on expert pies later) which has just 3 securities.

In this example, we have 3 slices with 3 ETFs that track an index related to dividend stocks. Since this an expert pie curated by M1 they have determined that it should contain VIG at 83%, DON at 13% and DES at 4% target allocation. This is a pie I have in my portfolio and as you can see above, due to market fluctuations the actual allocation has changed slightly.

Why Did I Switch to M1 Finance?

I use two primary approaches to investing both from a diversification and risk perspective.

- Automatic investing – I wanted a portfolio of securities that initially set the percentage allocation and then contribute to on a weekly basis. With this portfolio, after the initial setup I want to for the most part let it run on auto pilot. Maybe I’ll review once a quarter and make any tweaks or rebalance if needed

- Picking individual stocks – I occasionally want to invest in individual companies or stocks that I think will have a high future growth. The strategy here is to buy and hold long term. Due to my background, I have a natural bias towards technology stocks so I own shares of companies such as Alphabet, Tesla, Alibaba etc.

For automatic investing I had a Wealthfront account and for individual stock picks I used to E-Trade. No real complaints about each of these, but I decided to switch to M1 because it was versatile enough to help me do both on a single platform for free and if I choose to, have more control over the automatic investment scenario.

So this how I did it. I am sharing exactly how I used M1 so you can see just how powerful and impressive this tool is. For two scenarios I created two accounts in M1. By two M1 accounts, I am referring to separate taxable brokerage accounts under the same login since this will provide the best flexibility.

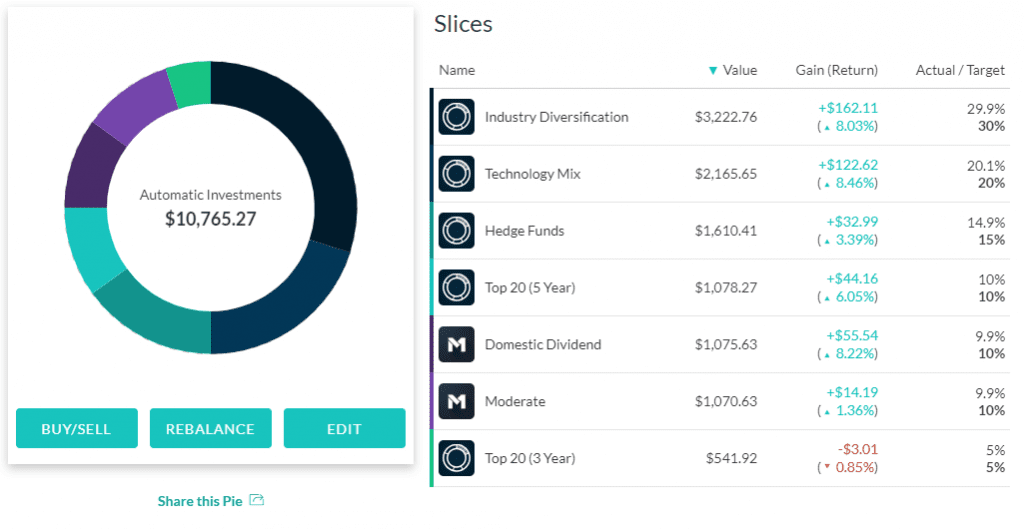

Automatic Investments

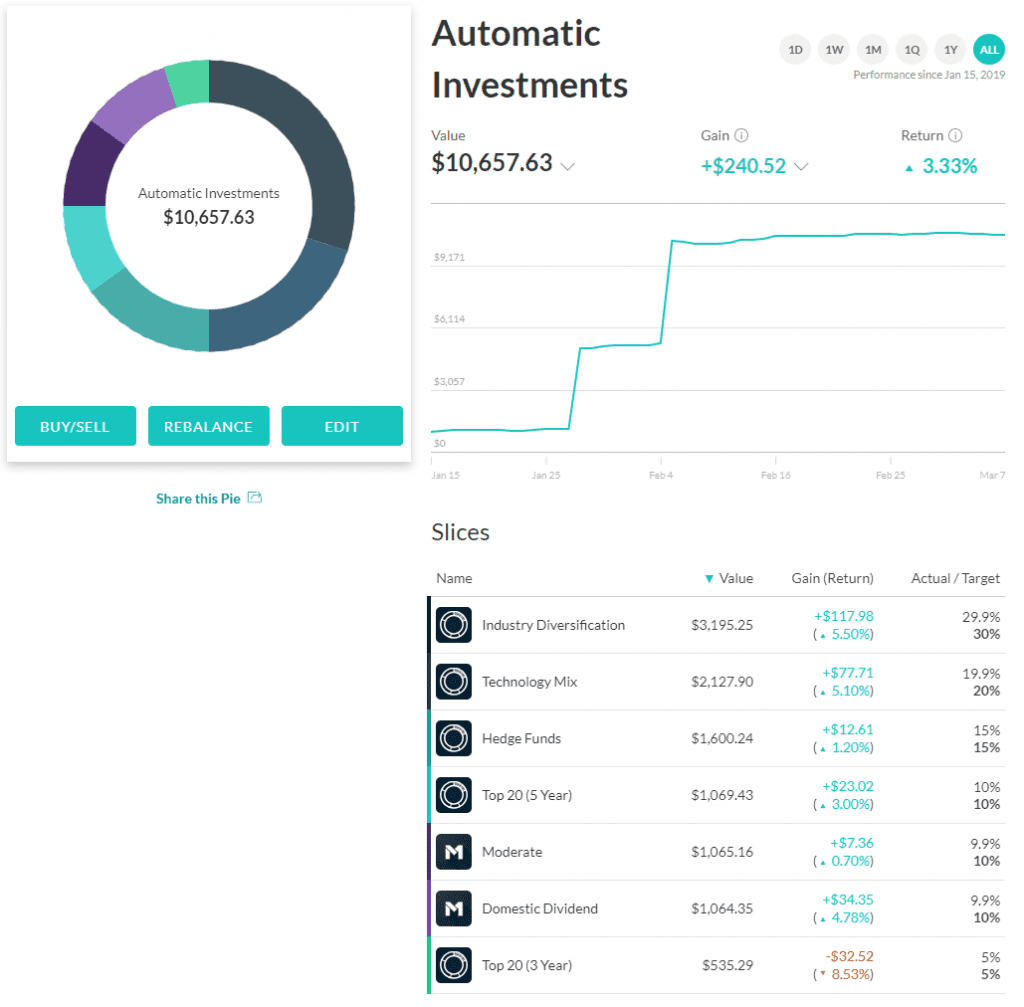

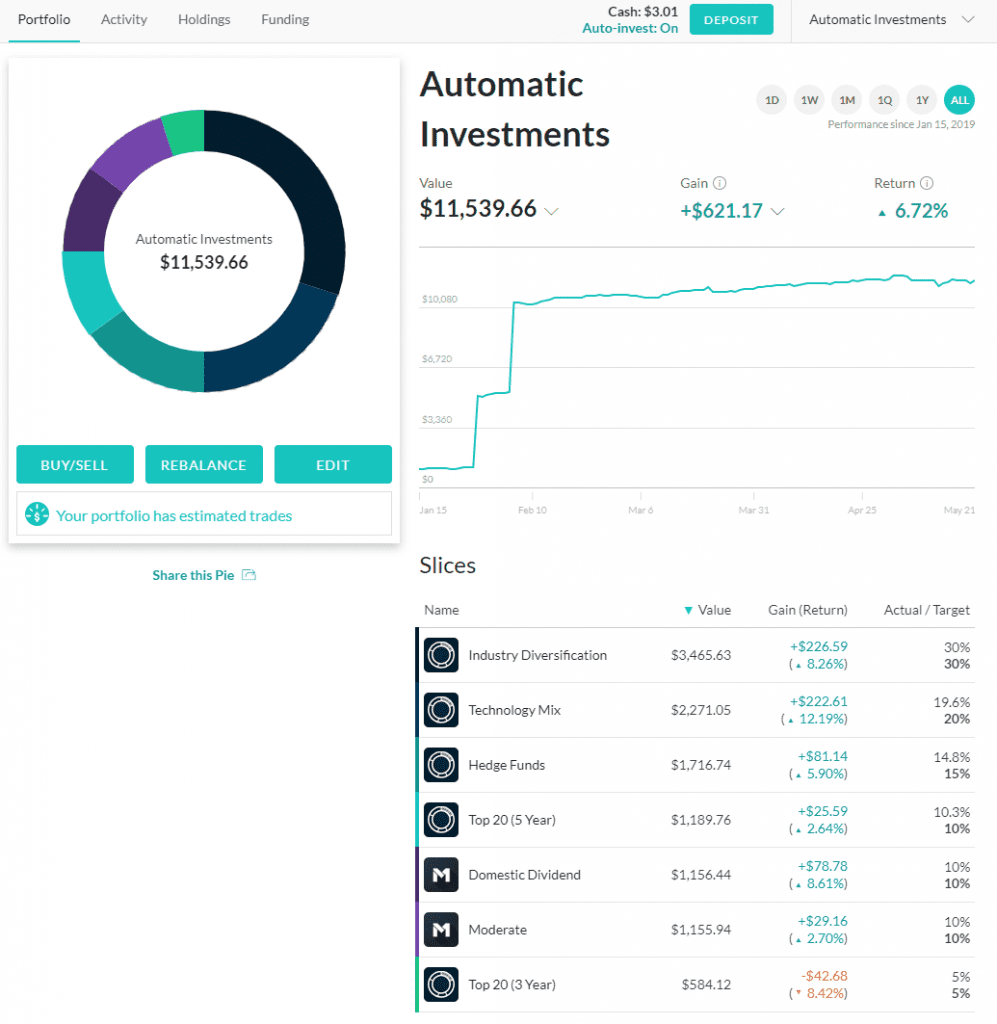

Before jumping in and creating pies like there’s no tomorrow, it’s a good idea to give some thought as to how you want to organize your portfolio and how you want to maximize return and minimize risk. This is what my top level portfolio looks like.

This dude must be mad… you must be thinking. Let me explain what I have done and how I did it.

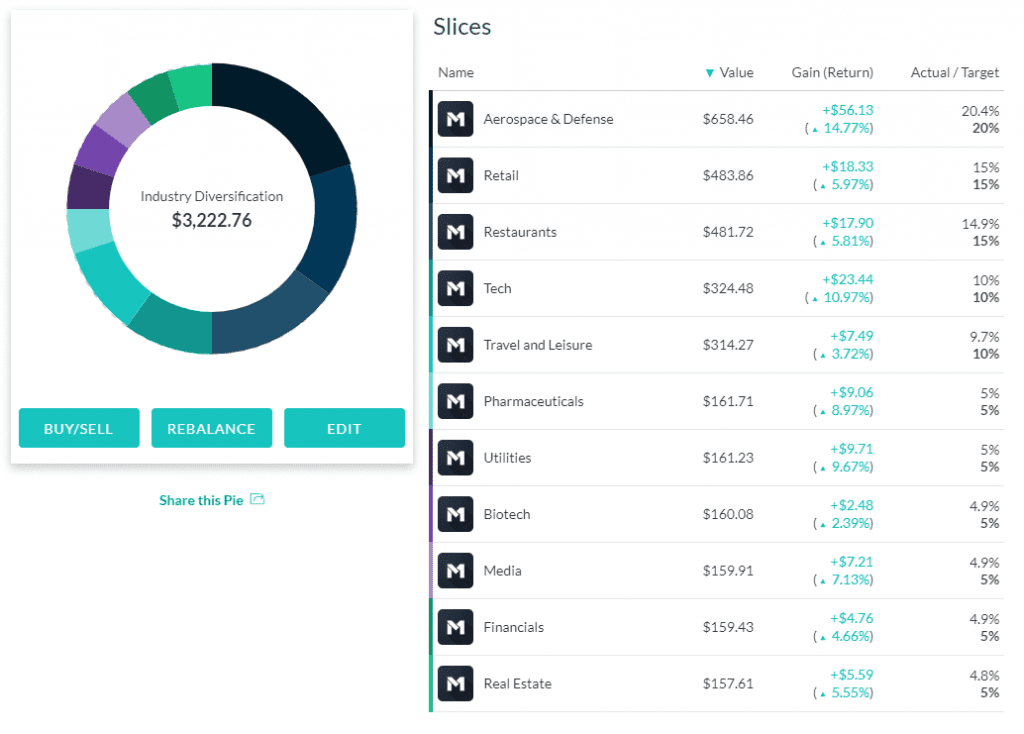

Industry Diversification Pie

Target Allocation: 30% | Click here to get this pie

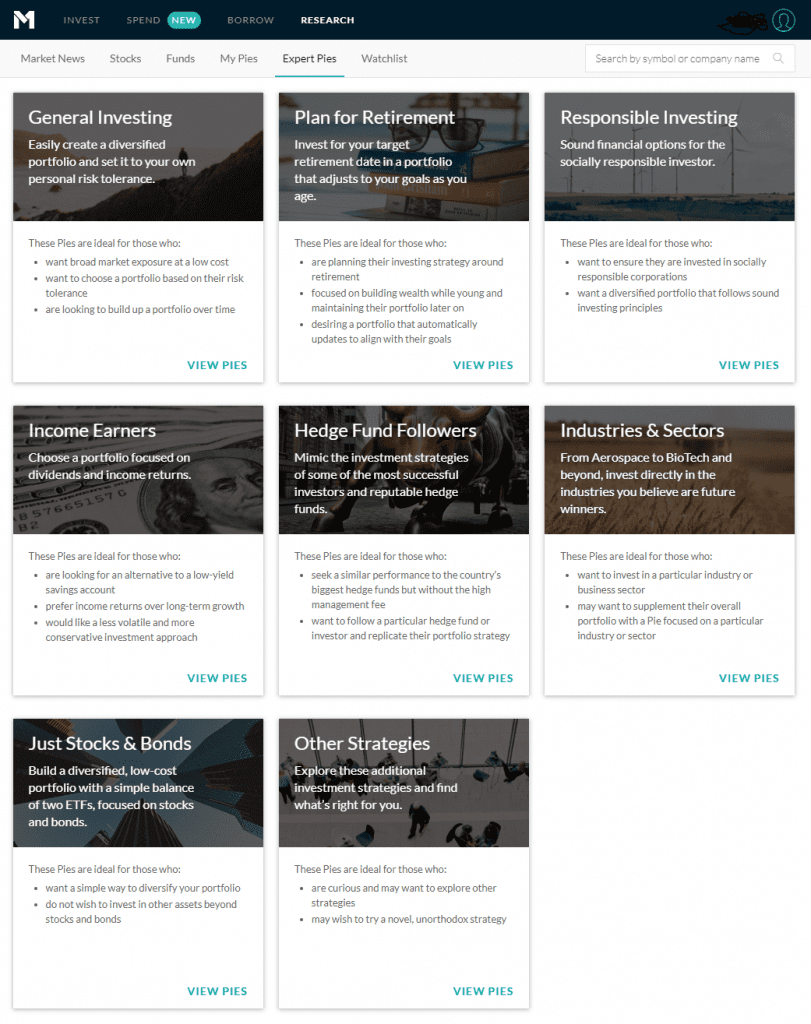

My current portfolio has a heavy technology bias, so I wanted to diversify into other industries. The problem was, I don’t have any expert knowledge in any other industry. This is where the M1 expert pies came to the rescue.

From the Industries & Sectors grouping, I picked the best performing industries in the last 3 and 5 years. Here’s what my custom pie that consists of expert pies looks like.

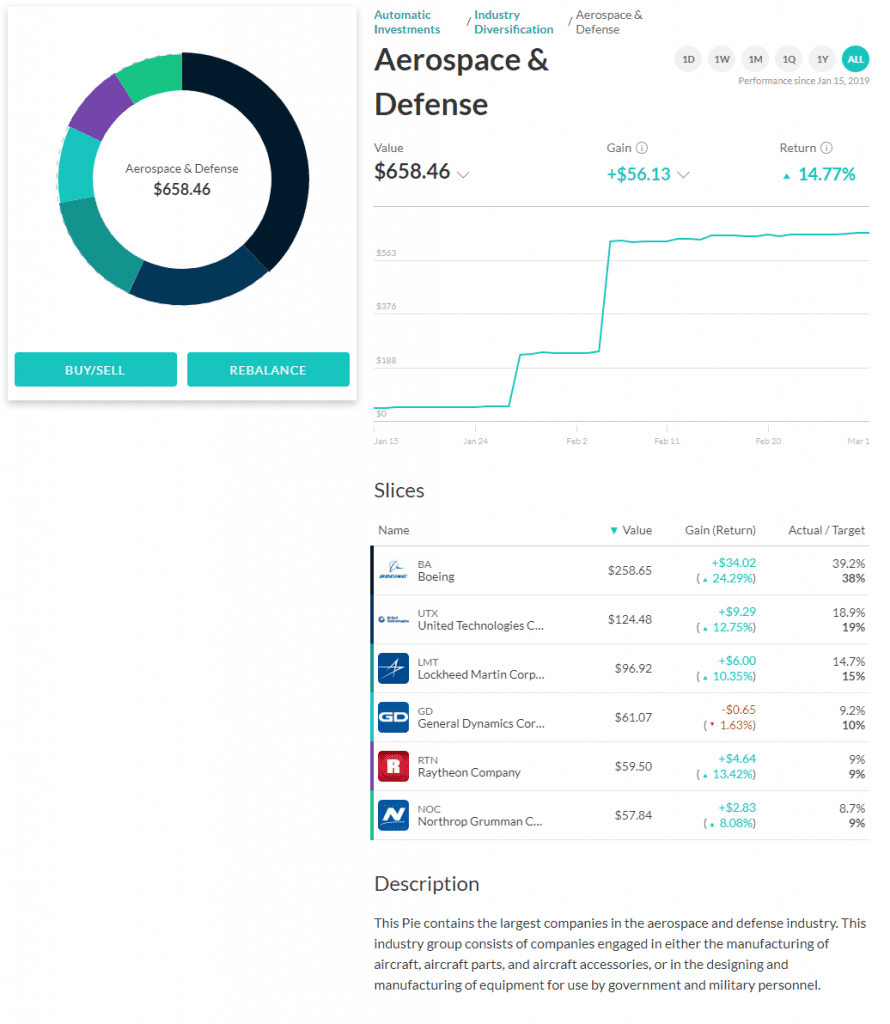

If you click into an industry sector you can see the individual stocks and how each slice is performing, if you want to get to that level of detail. For example, I went into the Aerospace and Defense pie/slice and I can see the stocks that are included and how they have performed. To help with navigation, the breadcrumbs at the top shows me where I am.

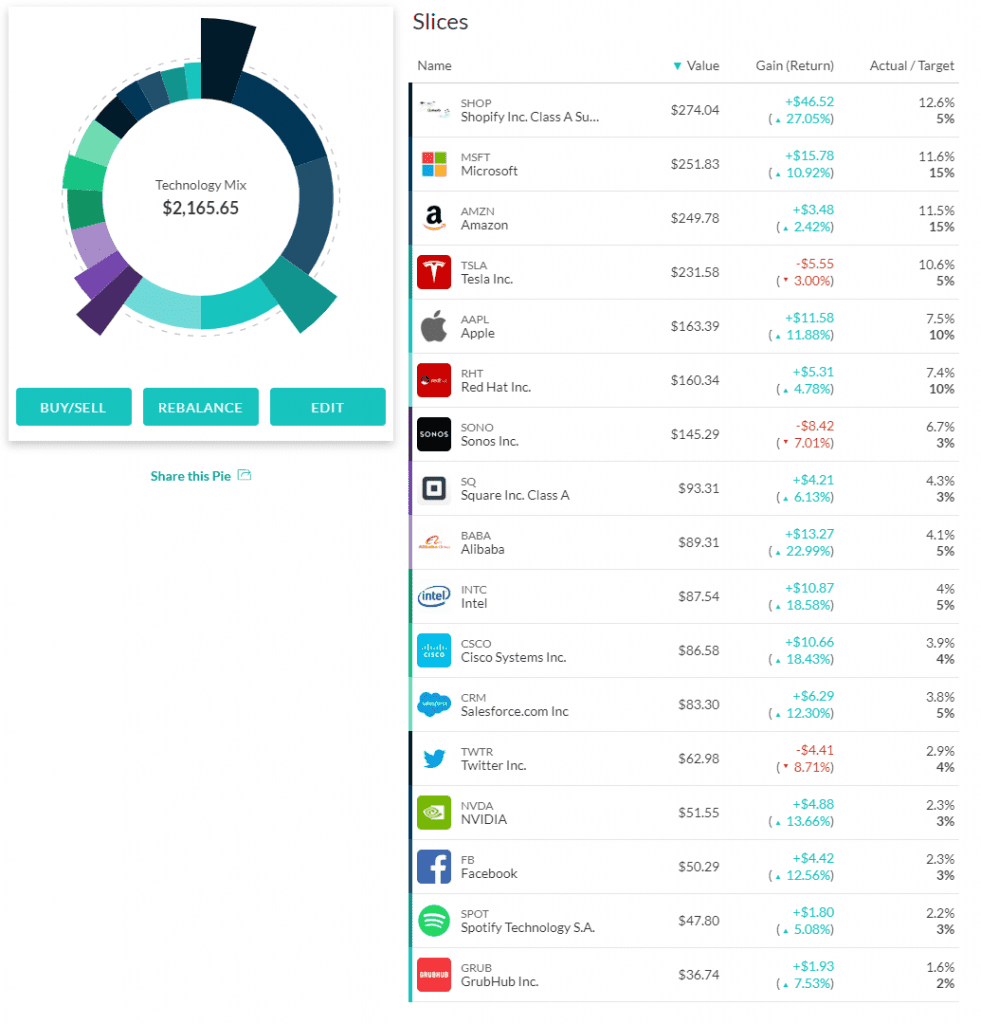

Technology Mix Pie

Target Allocation: 30% | Click here to get this pie

Did I mention I have technology bias? This is where I hand picked stocks of individual companies based on future long term growth potential and past performance.

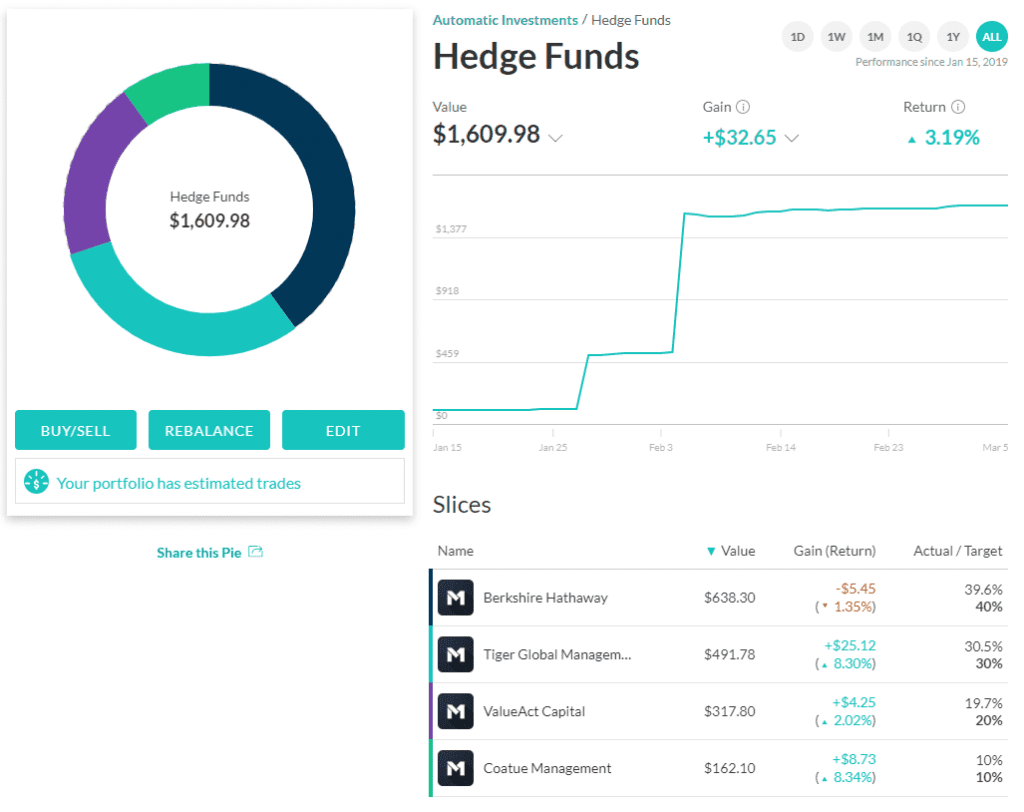

Hedge Funds Pie

Target Allocation: 30% | Click here to get this pie

How do you get access to the investments strategies of the most successful investors and hedge funds if you don’t have a boatload of money? Simple. Use the M1 hedge funds expert pies. M1 follows the strategies of several and I picked the following based on past performance and reputation. In general for all of these pies, M1 will match the allocation of the most recent 13F filing. 13 what filing? Money managers controlling investments of $100 million dollars or more must report their long equity holdings within 45 days of the quarter’s end in a 13F filing. By seeking to replicate a 13F, individuals can leverage the expertise and research of hedge funds without the management fees or minimums.

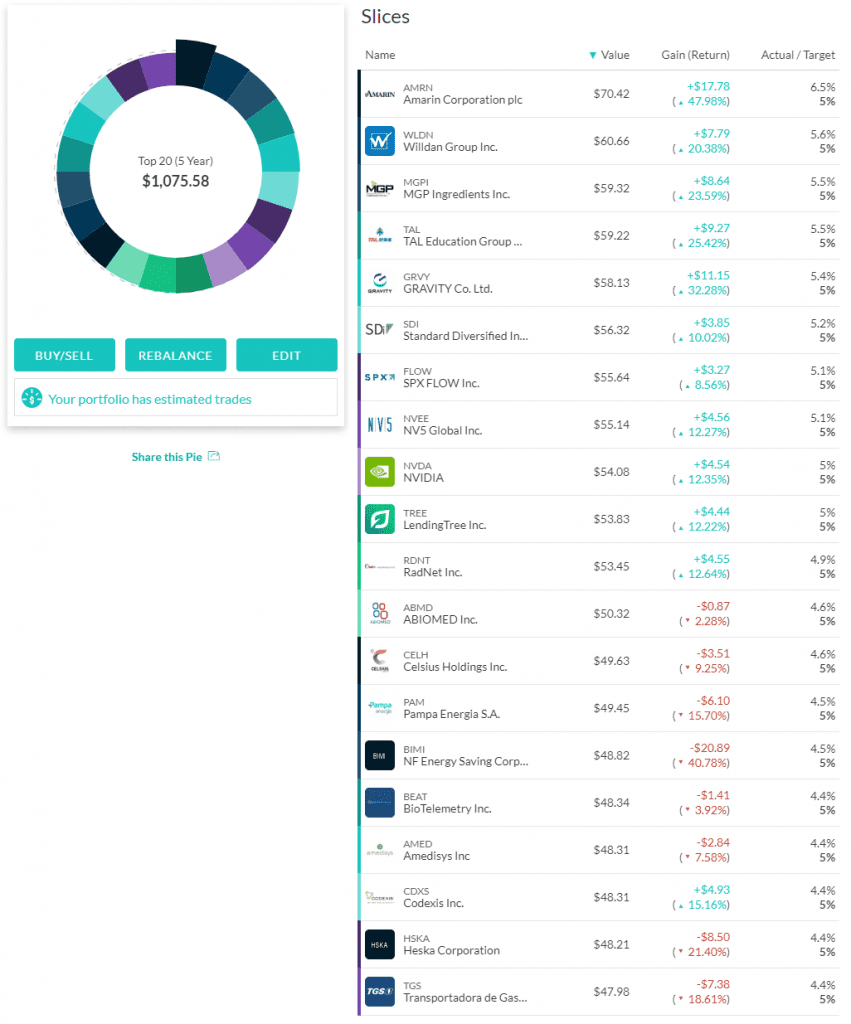

Top 20 5 Year and 3 Year Pies

Target Allocation: 10% (5 Year), 5% (3 Year) | Get the Top 20 (5 Year) Pie and Top 20 (3 Year) Pie

For these two pies, as the name implies, I took the best performing 20 stocks of the last 5 years and 3 years and created a pie out of it. This would be a relatively high risk pie, however, both pies combined only take up 15% of my portfolio and lets me invest in stocks I would otherwise not have considered or even heard of.

Expert Pies – Moderate and Domestic Dividend

Target Allocation: 10% each

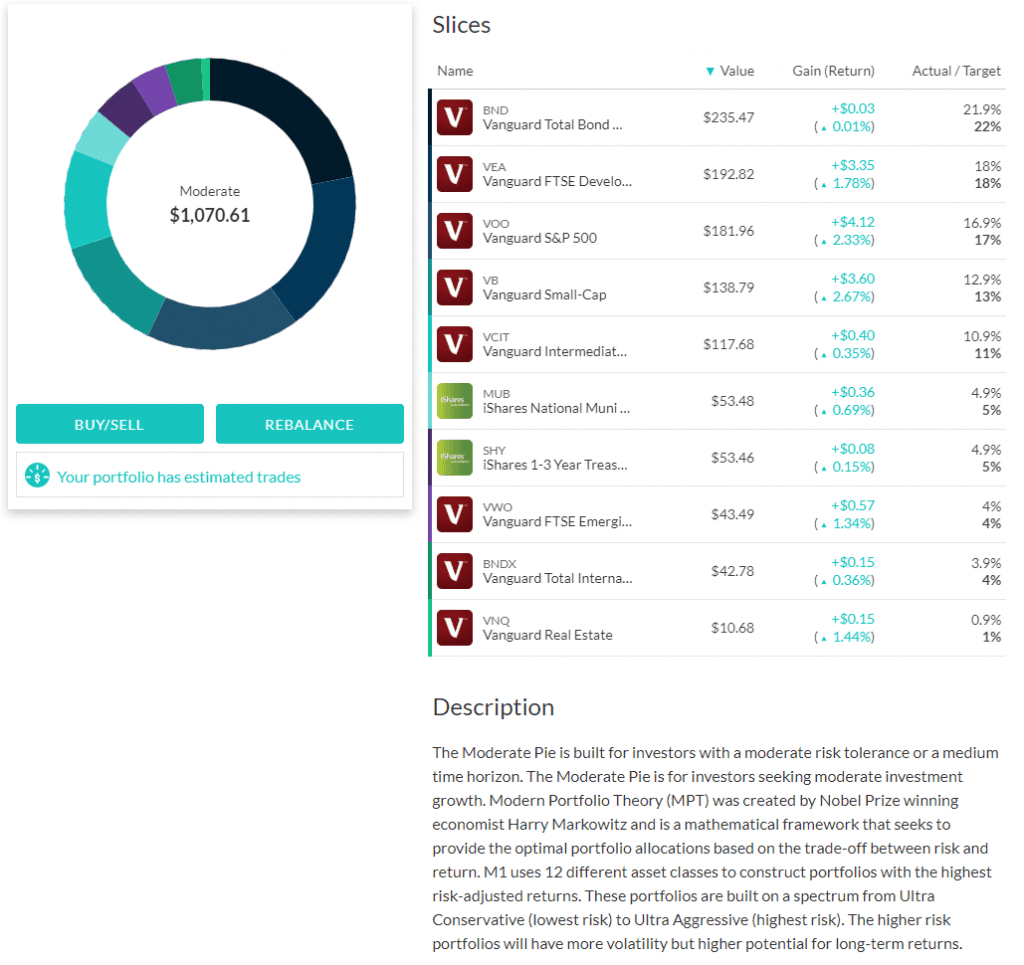

In general, my automatic investment portfolio is high risk because I have a long time horizon and of course because I am mad. To bring down the overall risk a bit I have added two expert pies, Moderate and Domestic Dividend which I think has a good balance of risk, but at the same time does not sacrifice growth too much.

The Moderate expert pie has the following ETFs. As you would expect it’s fairly high in bonds and has the Vanguard S&P 500 (VOO) ETF.

The Domestic Dividend expert pie primarily consists of Vanguard Div Appreciation (VIG) ETF which tracks a market-cap-weighted index of US companies that have increased their annual dividends for 10 or more consecutive years.

Putting It AlL together

And there you have it. My automatic investment portfolio consists of a mix of pies that I have created + expert pies from M1 where I thought it made sense. Put another way, M1 pies, or the hierarchy of pies you can create is very similar to how you would organize files in a Windows folder structure. If you would like to see this structure, click here to access my automatic investment portfolio and click through the multiple levels.

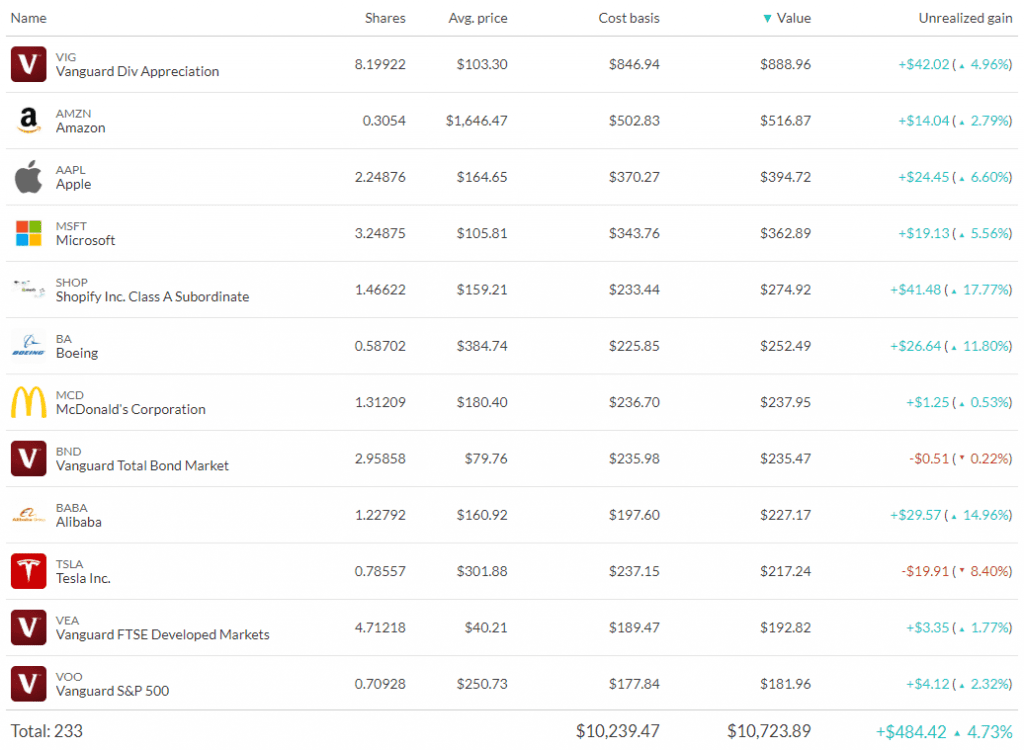

For this portfolio, I have a fixed amount being invested every week and for the most part I have set it and forget it approach. Maybe once a quarter I may adjust the allocation or rebalance. If I go over to the “Holdings” screen it gives a nice snapshot of the stocks and ETFs I own.

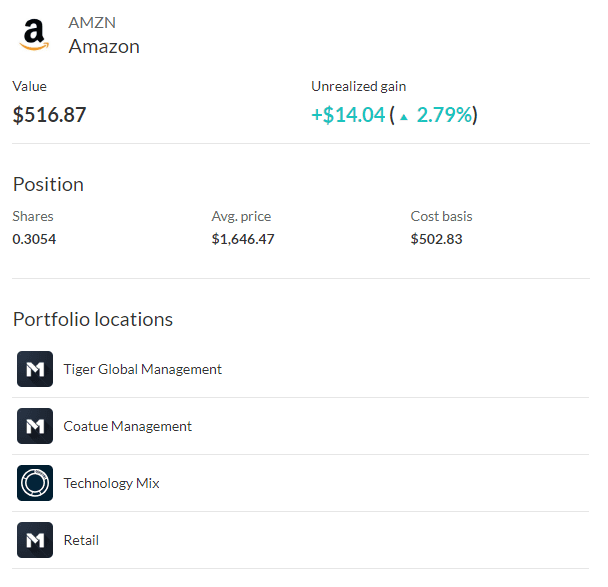

233 in total and do keep in mind that certain stocks/ETFs can be contained in multiple pies as is the case with Amazon (which is part of 4 pies). M1 does a nice job providing a consolidated view.

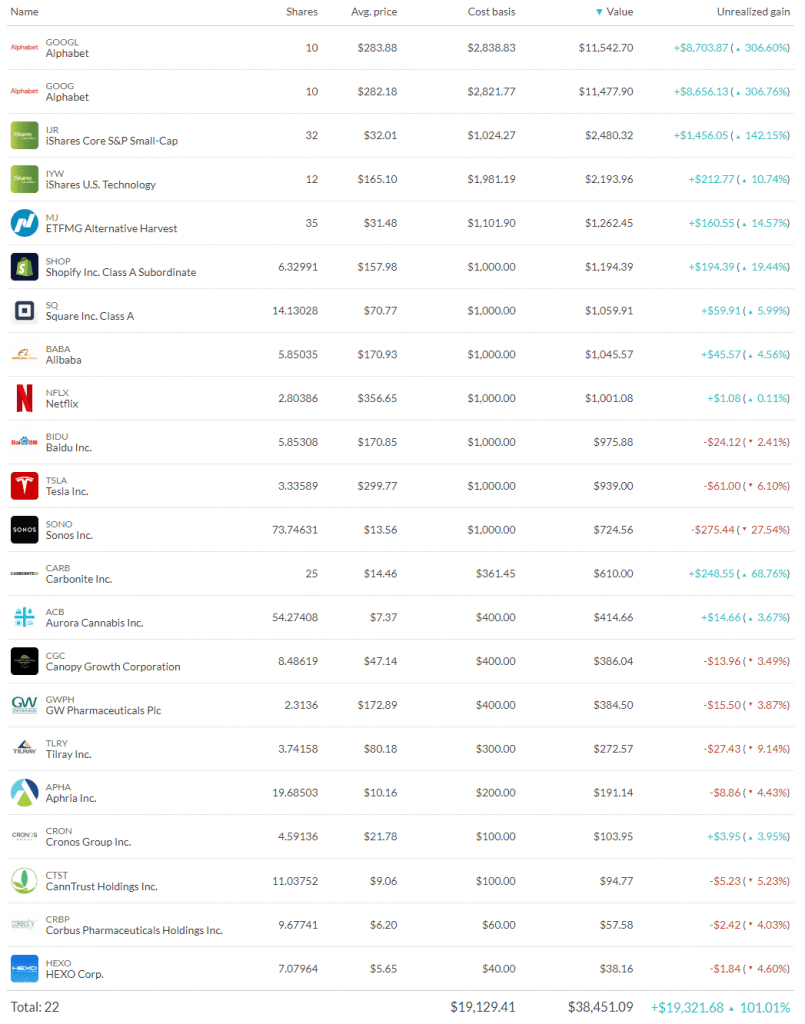

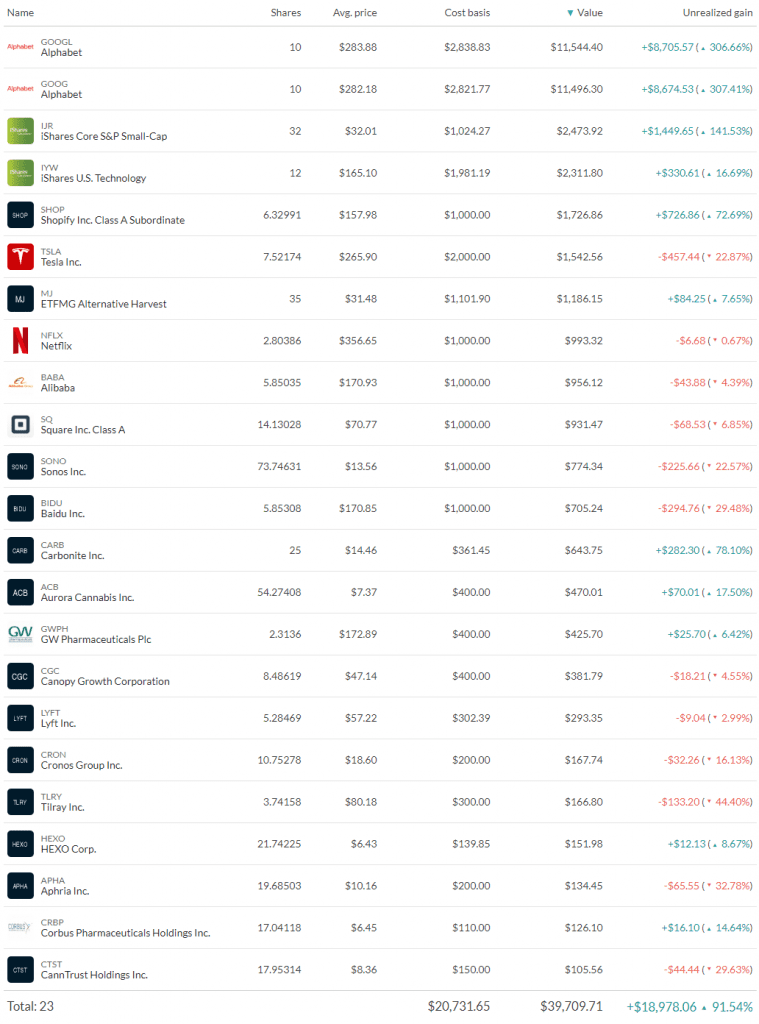

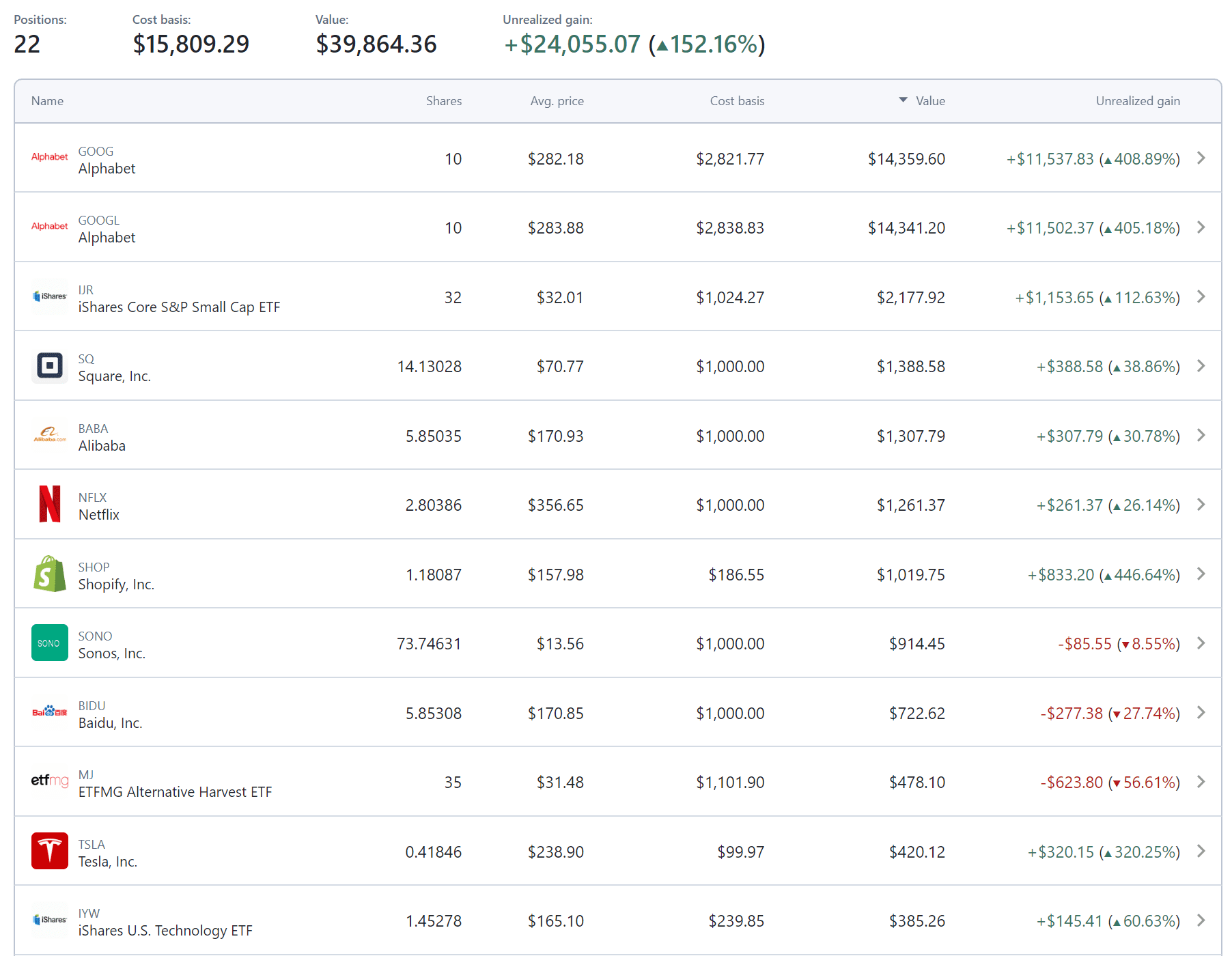

Individual Stock Picks

Occasionally I get the itch to buy stocks which I think are the next big thing. The very first stock I bought was Google around 9 years ago which has appreciated 300%. Since the first stock I picked did that well, I must be a mad stock picking genius, or so I think.

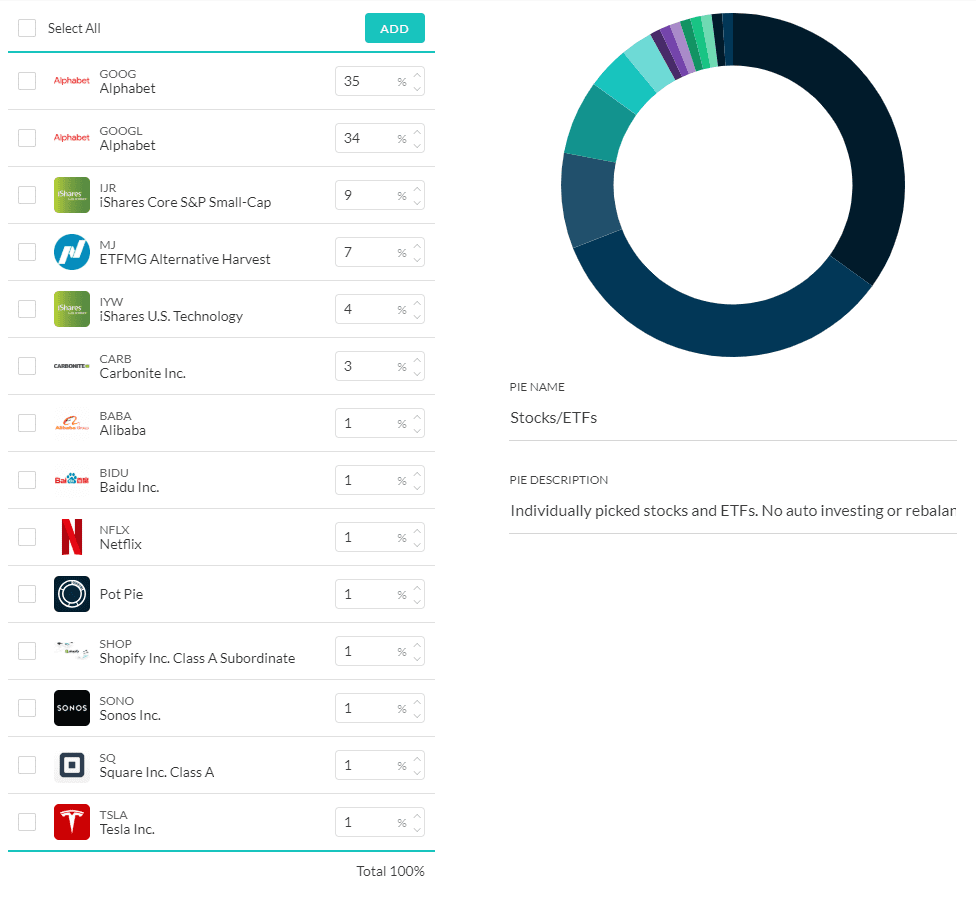

To achieve this in M1 can be a bit counterintuitive. M1 is all about pies, so you have to have a main pie which represents your portfolio and each stock or ETF will be a slice. To make sure this does not interfere with my automatic investing portfolio I created a separate account. Once you do this all you need to do is add the slices and enter a target allocation that adds up to 100. I will not be doing any auto investing or rebalancing on this account, so the target allocation doesn’t really matter.

As you can see I’ve named my main portfolio pie “Stocks/ETFs” which will make it easier for me to switch between accounts. For the target allocation, I simply put 1% for all the stocks that I bought after I started using M1. The first 6 stocks and ETF’s was transferred from E-Trade so I just put in the % allocation when it transferred in. In reality for this type of portfolio it really doesn’t matter as long as everything adds up to 100%, since I am choosing how much and when to invest in each security.

Performance

So how have my two portfolios performed? I will keep this section updated periodically (maybe at the beginning of every quarter so I can share with you which of my strategies have worked and which ones haven’t.

March 7, 2019 Update

I started using M1 on January 15, 2019 and here’s how my automatic portfolio has performed. What’s cool about this view is that it can tell you which slices/pies are performing well and you can then drill down and make adjustments/tweaks as needed. Of course we should resist the temptation to not have knee jerk reactions to short term market fluctuations.

Here’s the performance for the individual stock picks. Please note that these stocks were bought at different times and what is shown is the total gain (not annualized).

GOOG, GOOGL, IJR, IYW, MJ and CARB was transferred over from E-Trade. In the holdings page shown below the cost basis did transfer over so I can track my overall performance even though I have changed investing platforms over the years.

May 21, 2019 Update

Markets were going a bit crazy in May, but my automatic investment portfolio has held up well. I have $50 a week automatically going into this account. Considering all the volatility the 6.7% return is quite respectable (even if I say so myself)

Individual stocks picks have had quite a roller coaster. Here’s the key highlights since my last update on Mar 7, 2019.

- Google (no I will not call it Alphabet) had a few ups and downs but as of today remains unchanged

- I increased my investment in Tesla and it continues to tank… hmm, down 22%

- Shopify has been doing great, a whopping 72% gain

- Got my feet wet with a small $300 investment in Lyft. Will be watching that for awhile more before jumping in. I am also watching Uber and will probably at some point invest in a “ride share” pie.

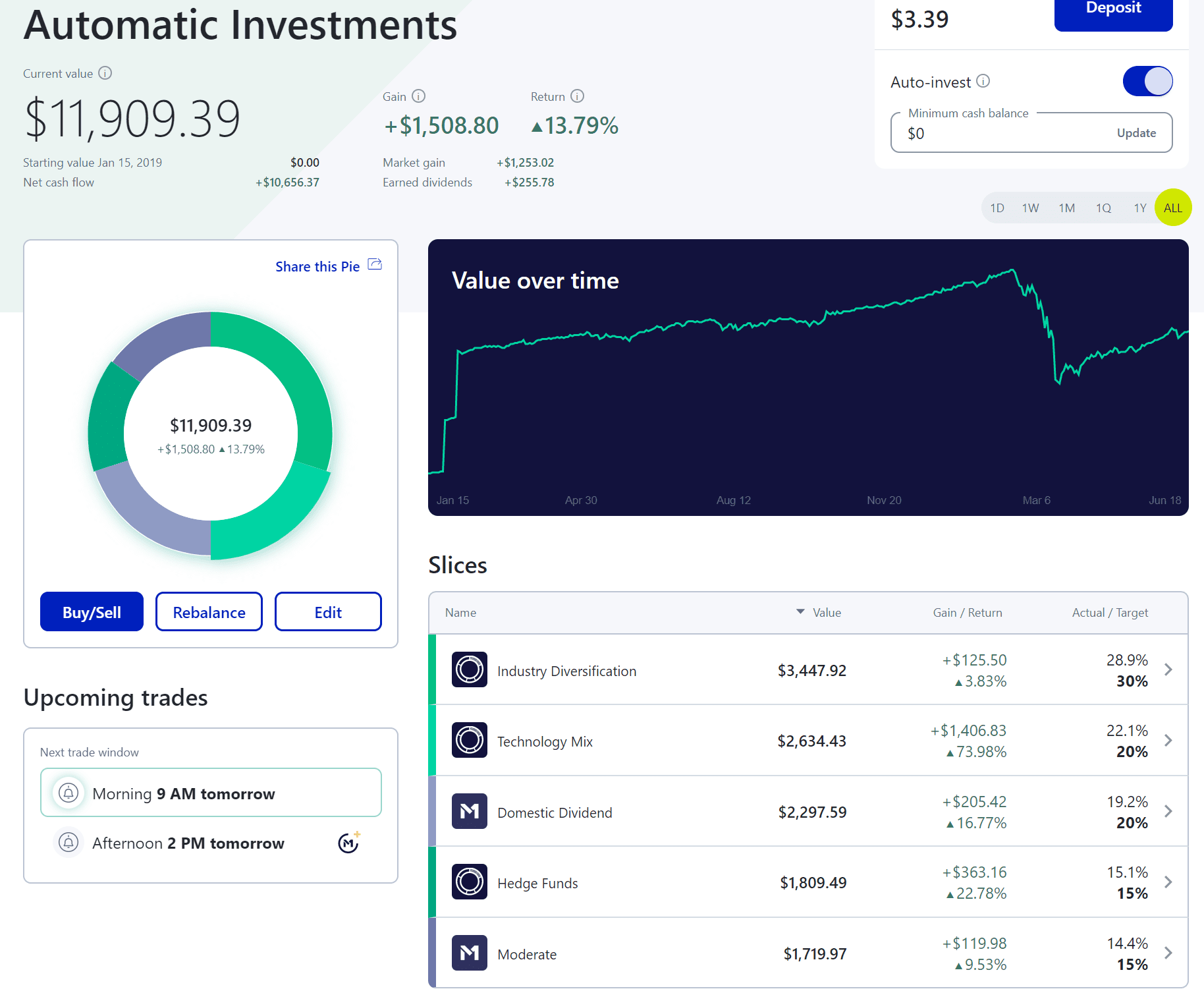

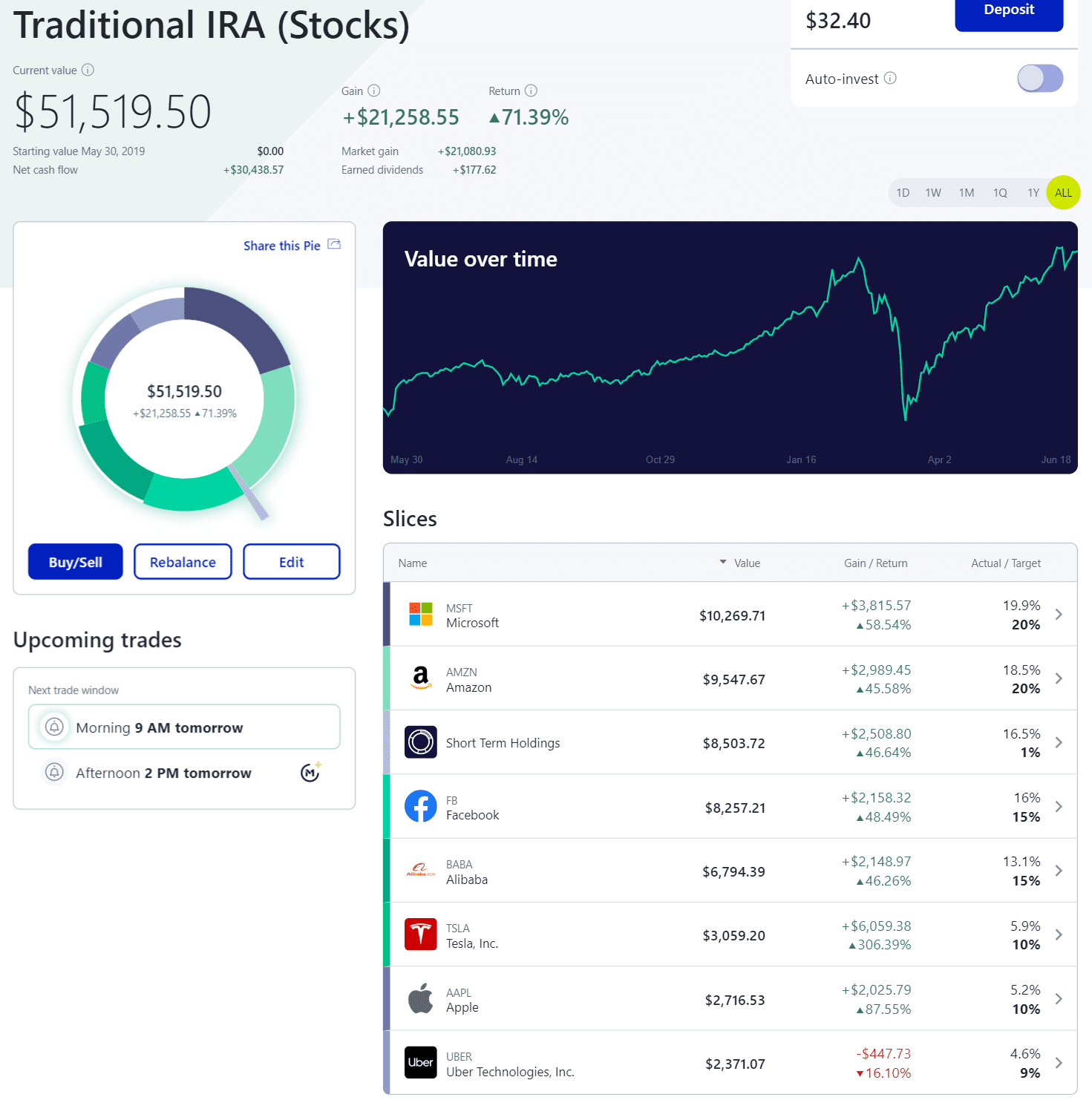

June 18, 2020 Update

It’s been awhile since my last update. No I didn’t die… just been busy with some crazy business ventures (don’t ask). So what’s changed since my last update? The markets have been on this mad bull run and then COVID happened. So here’s what my portfolio looks like after the roller coaster of a global pandemic. Only major change I made is getting rid of the top 20, 3 and 5 year pies which weren’t really performing. Besides that, it’s been $50 going in every week. Note the big dip in March below… that’s the COVID-19 knee jerk reaction. The key point here is tech stocks have continued to climb despite the potential extinction of the human race.

Individual stocks picks have had a few changes since my last update in May 2019.

- When the markets tanked in Mar 2020 I foolishly sold Tesla and Shopify. However, tech stocks continued to climb, so while I made a great return, in hindsight I should have held on to them.

- Airlines took a big hit, so I decided to jump on some Airline stocks. I wanted to do some trading here, so used my proceeds from the TSLA and SHOP sale to buy some airlines on Robinhood.

Final update I did on M1 was roll over an old 401k to a traditional IRA to invest in some tech stocks and also using it to get some airlines on sale these days. I plan to cash out on the airlines once they get to pre-pandemic levels and continue investing in tech stocks. So far, can’t complain about performance.

Conclusion

Just to reiterate, this blog was not a straight up review of M1 Finance, but, just like my other blogs, I’ve combined a review of the platform with sharing how I use it and the strategies that I use which work for me.

Do I recommend M1 Finance? Absolutely. I think it has the features to suit most investors and for me the most important part is that it has the flexibility to adapt to you if you change.

Will M1 work for everybody? In my opinion the only group of investor that I can say this will definitely not work for is a day trader or you want buy/sell stocks at any time during the day. M1 has a trading window during which it will execute your orders. For example, if you place an order today, it will execute the order the next business day during the trading window.

How to Get Started

1) Sign up for an M1 Finance account.

2) Fund your account – this step is optional. I would suggest to start with the minimum of $100, get familiar with platform and then invest more.

3) Create pies or you can use one or more of the pies that I have shared above as a starting point.

4) Start investing – invest the $100 or any other amount you chose above.

I want a M1 Account too!

QUESTIONS, COMMENTS, THOUGHTS, IDEAS?

I hope this review was helpful and you are able to take what I have done and adapt to your needs. I would love to hear any feedback or questions you have.